NCERT Solutions for Class 12 Entrepreneurship Chapter-6 Resource Mobilization

TEXTBOOK QUESTIONS SOLVED

SECTION-A: FINANCE

A. VERY SHORT ANSWER TYPE QUESTIONS

1.What do you understand by finance?

Answer. ‘Finance’ refers to funds or monetary resources needed by individuals, business houses and the government.

2.Give the significance of finance in an enterprise.

Answer. The significance of finance in enterprise is elucidated like a lubricant to the process of production.

3.Name the most important prerequisite to start an enterprise.

Answer. Finance is the most important prerequisite to start an enterprise.

4.State the most important factors for the survival of any business enterprise.

Answer. Financing, ‘production’, ‘marketing’ are deemed to be the most important factors for any business survival. Financing is considered to be the first because nothing can be done without money.

5.State how sources can broadly be classified into two major categories.

Answer. We know that these sources could broadly be classified into two major categories:

- Internal sources

- External sources

6. What do you understand by internal sources of finance?

Answer.Internal sources of finance is referred to as owner’s own money. It is also known as owner’s equity. Particularly in the case of small entrepreneurs the owner’s money is very small.

7.How will you differentiate between financial market with other market? Give one difference.

Answer. Financial market is a market in which people and entities can trade financial securities (stocks and bonds), commodities (including precious metals or agricultural goods), and others like crude oil etc. at prices that reflect supply and demand. Market refers to the aggregate of possible buyers and sellers of a certain good or service and the transactions between them.

8.‘Production’, ‘Marketing’, and Financing’ – deemed as the most important factors for any business’s survival rates. Among these name the most critical element and why?

Answer.Production, marketing, and financing, deemed to be the most important factors for any business survival. ‘ Financing’ is considered to be the first because no entrepreneur can start and run the business without money. Among this the most critical element for success in business is ‘Finance’. Before doing anything, an entrepreneur should clearly answer the following three questions:

- How much money is required?

- Where will money come from?

- When does the money need to be available?

B. SHORT ANSWER TYPE QUESTIONS

1.Which sources provide the supply for long-term funds?

Answer. Capital market consists of lenders and borrowers:

Lenders supply the funds.

Investors demand funds.

The supply of long-term funds comes from the following sources:

- Household savings

- Foreign capital

- Institutional investors

- Corporate savings

- The government

2.Name the sources of demand for capital comes from.

Answer. Capital market consists of lenders and borrowers:

- Lenders supply the funds

- Investors demand the funds The demand for capital comes from:

- Industrial Sector – It comes from the private sector into manufacturing or other economic activities.

- Government

3.Entrepreneur can use the capital raised for a variety of purposes, what are they?

Answer. Entrepreneur can use the capital raised for a variety of purposes including:

- Growth and expansion

- Retiring existing debt

- Corporate marketing and development

- Acquisition capital.

4.How can an entrepreneur, raises funds by selling the issue mainly to the institutional investors?

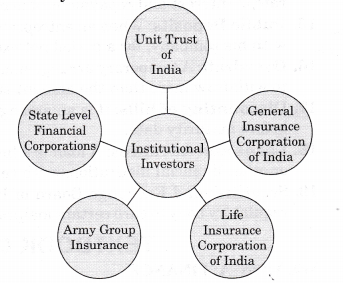

Answer. Private Placement: Any entrepreneur can directly sale of its securities of a company to a limited number of sophisticated investors. Entrepreneurs can raise funds by selling the securities mainly to the institutional investors like:

Entrepreneurs both from public limited and private limited sectors, banks heavily upon raising funds through the issues of varied financial instruments under this segment as at times they do not wish to disclose information to the open market.

5.How stock options lead to enable employees to become shareholders and share the profits of the company?

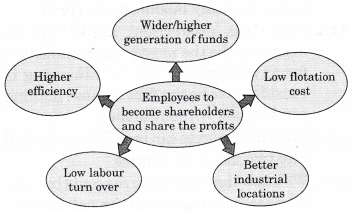

Answer. Stock options or offering shares to the employees has gained much popularity in many countries of the world. This method enables employees to become shareholders and share the profits of the company leading to:

C. LONG ANSWER TYPE QUESTION

1.Explain some important sources of raising finance in business.

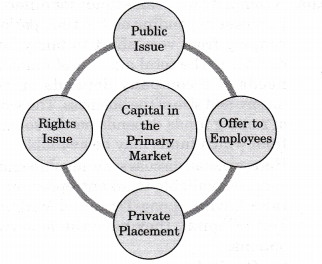

Answer. A. Methods of flotation of new issues: An entrepreneur can raise the required capital in the primary market by the following methods:

- Public issue

- Rights issue

- Private placement

- Offer to the employees

- Public issue: Public issue is the most popular method of raising capital these days by entrepreneurs. This involves raising of funds directly from the public through the issue of prospectus. An enterprise organizing itself as a public limited company can raise the required funds commonly by preparing a prospectus.

When an entrepreneur offers shares to the public for subscription he/she is required to comply with all the restrictions and formalities pertaining to the initial issues, prospectus drafting and launch.

One of the most difficult problems in the new venture creation process is obtaining finance when an entrepreneur decides to go public and become a public company. - Rights issue: Rights issue is a method of raising additional finance from existing shareholders by offering securities to them on pro-rata basis i.e. giving them a right to a certain number of shares in proportion to the shares they are holding.

Normally, through a circular, rights issues are proposed to the existing shareholders and in case they are not willing to subscribe, they can renounce the same in favour of another person. This method of issuing securities is considered to be inexpensive as it does not require any brokers, agents, underwriters, prospectus or enlistment, etc. - Private placement: Private placement means the direct sale by a company of its securities to a limited number of sophisticated investors. Entrepreneurs, herein, raise funds by selling the issues mainly to the institutional investors like:

• Unit Trust of India

• Life Insurance Corporation of India

• General Insurance Corporation of India

• Army Group Insurance

• State Level Financial Corporations, etc.

Entrepreneurs both from public limited and private limited sectors bank heavily upon raising funds through the issue of varied financial instruments under this segment as at times they do not wish to disclose information to the open market. - Offer to employees: Stock options or offering shares to the employees has gained much popularity in many countries of the world. This method enables employees to become shareholders and share the profits of the company leading to:

• Higher efficiency

• Low labour turnover

• Better industrial locations

• Low floatation cost

• Wider/higher generation of funds.

B. Angle investors: Business angle or informal investor or an angle investor, is an affluent individual who provides capital for a business start-up and early stage companies having a high-risk, high-return matrix usually in exchange for convertible debt or ownership equity. Venture capital is a type of private equity capital provided as seed funding to early-stage, high potential, high risk, grown up companies/entrepreneurs who lack the necessary experience and funds to give shape to their ideas.

- It is basically equity finance in relatively new companies.

- It is long-term investment in growth- oriented small or medium firms.

- Venture capitalists not only provide capital but also business skills to investee firms.

- It involves high risk-return spectrum. Funding: Obtaining venture capital is substantially different

from raising debt or a loan from a lender. Lenders have a legal right to interest on a loan and repayment of the capital, irrespective of the success or failure of a business.

SFIs were established to meet the long-term financial requirement of such enterprises on economic and social ground. These Specialized Financial Institutions in India are not only committed to financial services but are also devoted towards playing a role of a promotional “mentor” and technical advisor to a wide range of the upcoming and existing entrepreneurs. Thus, these Specialized Financial Institutions (SFIs) make an important source of medium and long¬term financing amongst all the financial institutions in India, to the industry.

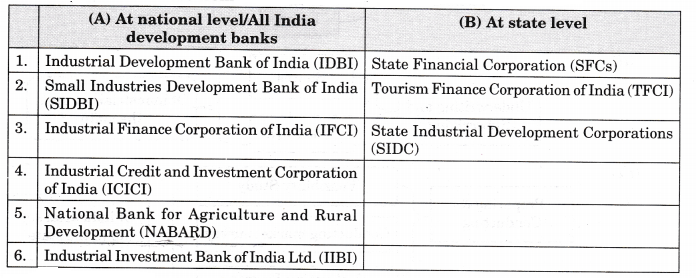

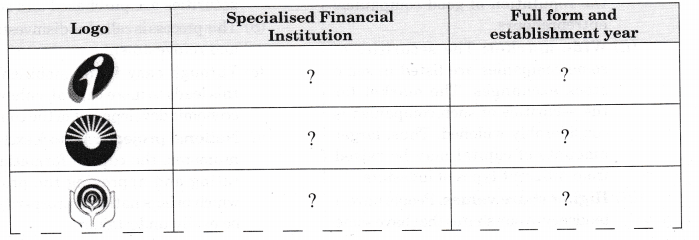

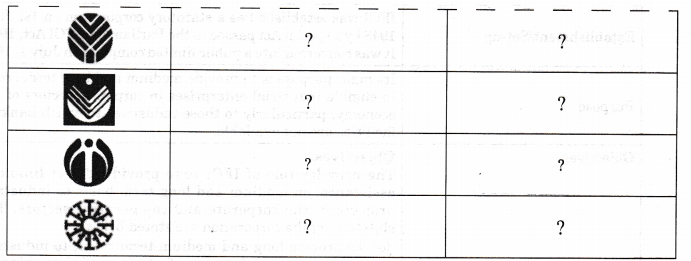

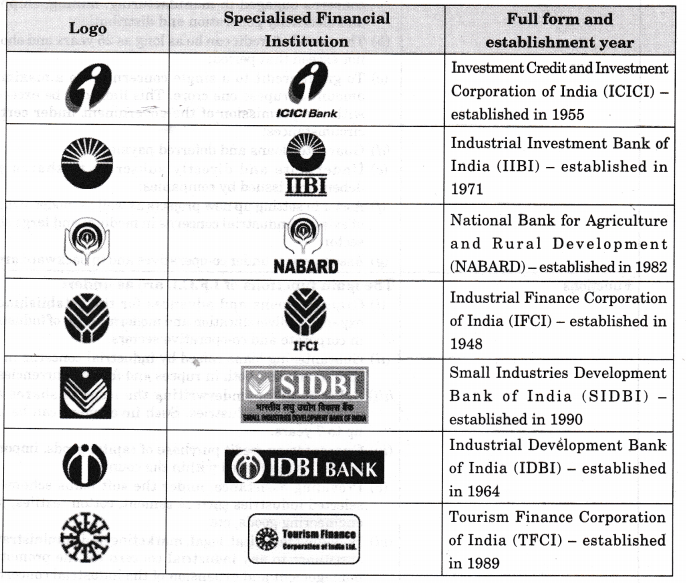

A. At national level/All India development banks

- Industrial Development Bank of India (IDBI)

- Small Industries Development-Bank of India (SIDBI)

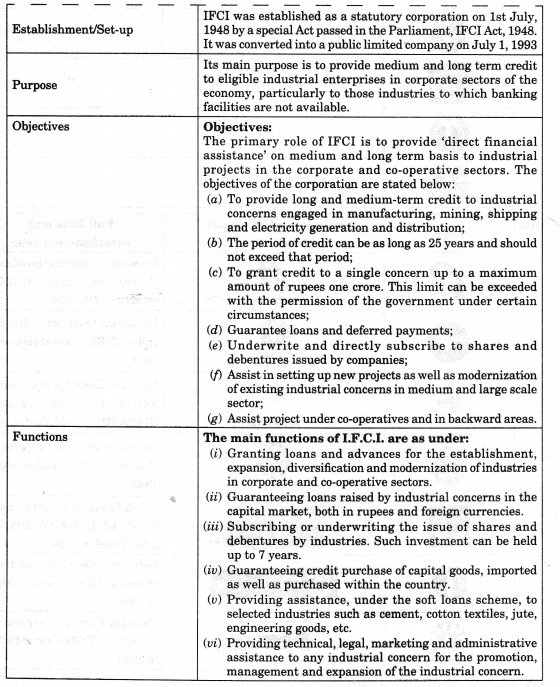

- Industrial Finance Corporation of India (IFCI)

- Industrial Credit and Investment Corporation of India (ICICI)

- National Bank for Agriculture and Rural Development (NABARD)

- Industrial Investment Bank of India Ltd. (IIBI)

B. At state level

- State Financial Corporation (SFCs)

- Tourism Finance Corporation of India (TFCI)

- State Industrial Development Corporations (SIDC)

SECTION-B: FINANCIAL MARKETS

A. VERY SHORT ANSWER TYPE QUESTIONS

1.Define capital market.

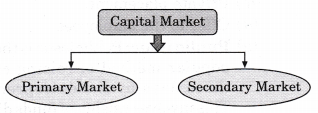

Answer. A capital market may be defined as an organized mechanism meant for effective and smooth transfer of money capital or financial resources from the investors to the entrepreneurs.

2.Name the two players in the capital market.

Answer.

3.Identify the reward IPO investors seek as an appreciation of their investment.

Answer. The only reward the IPO investors seek is an appreciation of their investment and possibly dividends.

4.Identify the method of raising additional finance from existing shareholders by offering securities to them on pro-rata basis.

Answer. Rights issue is a method of raising additional finance from existing shareholders by offering securities to them on pro-rata basis.

5.What do you understand by pro-rata allotment of securities?

Answer. It is used to describe a proportionate allocation. It is a method of assigning shareholders a right to a certain number of shares in proportion to the shares they are holding.

6.What is Right Issue?

Answer.Rights issue is a method of raising additional finance from existing shareholders by offering securities to them on pro-rata basis i.e. giving them a right to a certain number of shares in proportion to the shares they are holding.

7.When the right issue are proposed to the existing shareholders and if they are not ready to subscribe what is the next step taken by an entrepreneur?

Answer.When rights issues are proposed to the existing shareholders and in case they are not willing to subscribe, they can renounce the same in favour of another person.

8.Why right issue method of issuing securities is considered to be inexpensive?

Answer.The right issuing securities is considered to be inexpensive as no intermediaries are required like any brokers, agents, underwriters, prospectus or enlistment, etc.

9.What do you understand by private placement?

Answer.Private placement means the direct sale by a company of its securities to a limited number of sophisticated investors.

10.What is meant by stock options or offering shares to the employees?

Answer. A stock option is granted to specified employees of a company. ESOs carry the right, but not the obligation, to buy a certain amount of shares in the company at a predetermined price.

11.Name the method which enables employees to become shareholders and share the profits of the company.

Answer.Stock options or offering shares to the employees is the method that enables employees to become shareholders and share the profits of the company.

12.What is a secondary market?

Answer. It refers to the market for the purchase and some of existing securities i.e. the market securities issued earlier are sold by existing investors in this market.

13.What is the need of secondary market?

Answer. The secondary capital market, which is also known as old securities market or stock exchange deals with buying and selling of old securities i.e. the market securities issued earlier are sold by existing investors in this market, thus paving way for the entrepreneurs that if they offer high returns to market, investors will remain inclined to invest therein. The secondary market enhances the marketability of securities and thereby provides liquidity to investments.

14.In what forms company can raise capital through primary market?

Answer. An entrepreneur can raise the required capital in the primary market by the following methods:

B.SHORT ANSWER TYPE QUESTIONS

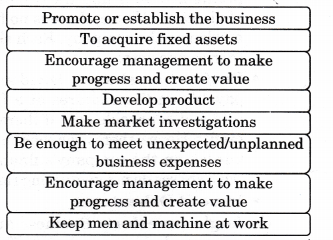

1.For what purpose is finance required right from the very beginning i.e. conceiving an idea?

Answer.

2.What is the need of finance?

Answer.

- Finance is one of the important prerequisites to start an enterprise.

- It helps an entrepreneur to arrange all other required resources together like, personnel, machines, materials, methods, land, etc. to start up the business systematically.

- It helps an entrepreneur to start and run his business activities smoothly and convert a dream into reality.

3.An entrepreneur is a person who bears the risks, unites various factors of production and carries out a creative innovation, and for doing all these, what is the basic requirement to be reached to this extent.

Answer. Finance.

4.State some mushrooming sources of raising finance in the business.

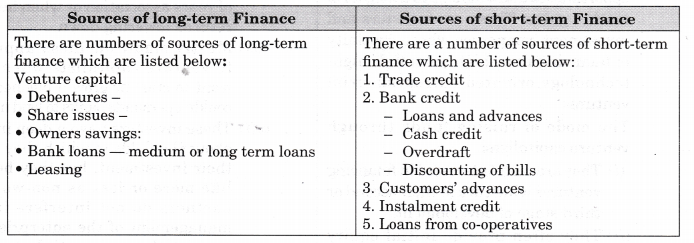

Answer. A company may raise funds for different purposes depending on the time periods ranging from very short to fairly long duration. The total amount of financial needs of a company depends on the nature and size of the business. The scope of raising funds depends on the sources from which funds may be available. Here, we shall discuss some mushrooming sources available to an entrepreneur to raise finance; Long-Term and Medium- Term Capital, they have the following options:

- Capital markets:

• Issue of Shares

Equity shares: The rate of dividend on these shares depends on the profits available and the discretion of directors. Hence, there is no fixed burden on the company. Each share carries one vote.

• Preference shares: Dividend is payable on these shares at a fixed rate and is payable only if there are profits. Hence, there is no compulsory burden on the company’s finances. Such shares do not give voting rights.

• Issue of Debentures. - Angle investors: Business angle or an angle investor, is an affluent individual who provides capital for a business start-up and early stage companies having a high-risk, high- return matrix usually in exchange for convertible debt or ownership equity.

- Venture capital: Venture capital is an equity based investment in a growth-oriented small to medium business to enable the investors to accomplish objectives, in return for minority shareholding in the business. It is a way in which investors support entrepreneurial talent with finance and business skills to exploit market opportunities and obtain long-term capital gains.

- Specialized financial institutions Specialized Financial Institutions (SFIs) make an important source of medium and long term financing amongst all the financial institutions in India, to the industry.

A. At national level/All India development banks

- Industrial Development Bank of India (IDBI)

- Small Industries Development Bank of India (SIDBI)

- Industrial Finance Corporation of India (IFCI)

B. At state level

- State Financial Corporation (SFC)

- Tourism Finance Corporation of India (TFCI)

- State Industrial Development Corporations (SIDC).

C. LONG ANSWER TYPE QUESTIONS

1.State the nature of money market. Who are the major participants in the money market?

Answer.Money market refers to transactions involving lending and borrowing of money for short periods like a day a week a month or 3 to 6 months. It meets the short term requirements.

The major participants in the market are:

- Reserve Bank of India

- Commercial Banks, Cooperative Banks

- Non-Banking Finance Companies

- State Government

- Large Corporate Houses and Mutual Funds

- LIC, GIC, UTI, etc.

2.Explain how capital markets are the most important source of raising finance for an entrepreneur.

Answer. Capital markets are the most important source of raising finance for the entrepreneurs. This market:

- Mobilises the financial resources on a nation-wide scale.

- Secures the much required foreign capital and know-how to promote economic growth at a faster rate.

- Ensures the most effective allocation of the mobilized financial resources by directing the same either to such projects which are capable of the highest yield or to the under developed priority areas where there is an urgent need to promote balanced and diversified industrialization. The needs of entrepreneurs who actually use the savings for productive purposes are varied. The capital market satisfies the tastes of savers and the needs of investors through its financial instruments and institutions.

3. What do you understand by capital market? How can the capital market in India be broadly classified into different categories?

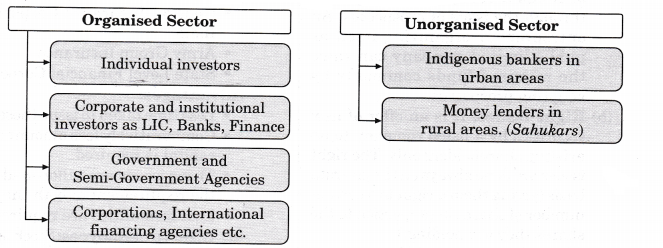

Answer.A capital market may be defined as an organized mechanism meant for effective and smooth transfer of money capital or financial resources from the investors to the entrepreneurs. The capital market in India may be broadly classified into:

4.Write down the sectors of organized and unorganized market.

Answer. The capital market in India may be broadly classified into:

A. Organized Markets: This segment comprises of

- Corporate enterprises

- Government and semi-government institutions requiring funds for various development activities

- Individual investors

- Corporate and institutional investors, as LIC, Banks, Finance Corporations, International financing agencies, etc.

B. Unorganized Sector:

The unorganized sector consists of

- The indigenous bankers in urban areas.

- The money lenders in rural areas.

5.What is meant by primary market? Briefly explain the concept of ‘Right Issue for existing companies’.

Answer. Primary market is basically meant to facilitate transfer of resources from the savers to the entrepreneurs seeking funds for:

- Setting new enterprises,

- Expanding,

- Diversifying.

- Rights issue is a method of raising additional finance from existing shareholders by offering securities to them on pro-rata basis i.e. giving them a right to a certain number of shares in proportion to the shares they are holding.

- It is proposed through a circular to all the existing shareholders only.

- It is not mandatory to purchase these shares if any shareholders are not willing to subscribe, they can reject or disclaim and others can subscribe for it.

D. VERY LONG ANSWER TYPE QUESTIONS

1.“An entrepreneur can raise the required capital in the primary market.” Explain the various methods of raising the funds in the primary market by an entrepreneur.

Answer. Yes, an entrepreneur can raise the required capital in the primary market. The various methods of raising the funds in the primary market by an entrepreneur are as follows :

- Public Issue

- Rights Issue

- Private Placement

- Offer to the employees

- Public Issue/Going Public: Public issue is the most popular method of raising capital these days by the entrepreneurs. This involves raising of funds directly from the public through the issue of prospectus. An entrepreneur organizing itself as public limited company can raise the required funds commonly by adopting prospectus.

- Right Issues: It is an offer of new securities by a listed company to its existing shareholders only. The right issues are done always on the pro-rata basis (giving them a right to a certain number of shares in proportion to the shares they are holding.)

• The companies send the letter of offer (circular) to all those existing shareholders whose names are recorded in the books on a particular date to issue rights.

• The time given to accept the right offer should not be less than 15 days.

• The circular/notice issued to the shareholder must state the right of the shareholder to renounce the offer in favour of others.

• After the expiry of the time mentioned in the notice, the Board of Directors has the right to dispose the unsubscribed shares in any manner as per the benefit of the company.

The existing shareholders whose names are there in the list has four options:

• They can exercise the rights.

• They can renounce the rights and sell them the same in the open market in favour of another person.

• They can renounce part of the rights and exercise the other part.

• Doing nothing.

This method of issuing securities is considered to be inexpensive as it does not require any brokers, agents, underwriters, prospectus or enlistment, etc. - Private Placement: It refers to the direct sale of newly issued securities by the company to a small number of institutional investors through merchant bankers. They are generally selected clients.

• Unit Trust of India

• Life Insurance Corporation of India

• General Insurance Corporation of India

• Army Group Insurance

• State Level Financial Corporations

Advantages:

• Less time taken to issue these shares.

• Comparatively less amount of cost of capital is req*fired.

• These issues are tailor-made to suit the requirement of both the parties.

• Less formalities are required. - Offer to employees: Stock options to the employees refers to the offer given by the company to the employees to become shareholders. This method facilitates the employees to become shareholder and can earn a part of the share of profits.

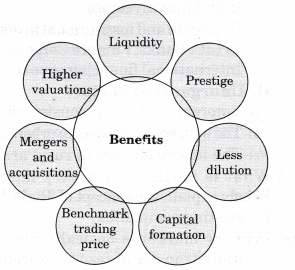

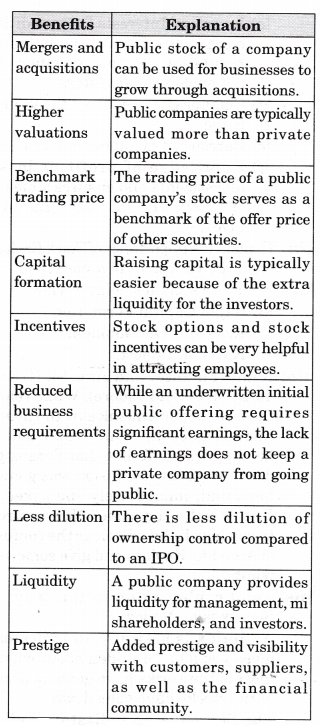

2.When an entrepreneur decides to go public and become a public company, he/ she tends to be in advantageous position and get many benefits out of it. Explain the benefits.

Answer.

3.While there are benefits to going public, at the same time additional obligations and reporting requirements on the companies and its directors means disadvantages too. What are they? Explain.

Answer.While there are benefits to going public, it also means additional obligations and reporting requirements such as:

- Increasing accountability to public shareholders

- Need to maintain dividend and profit growth trends

- Becoming more vulnerable to an unwelcome takeover

- Need to observe and adhere strictly to the rules and regulations by governing bodies

- Increasing costs in complying with higher level of reporting requirements

- Relinquishing some control of the company following the public offering

- Suffering a loss of privacy as a result of media interest

Discussions with lawyers, independent accountants and other professional advisors will also provide better considerations.

Overall, going public is a complex decision that requires careful consideration and planning.

Entrepreneurs should examine their current and future capital needs, and be aware of how an IPO will affect the availability of future financing.

E. HIGHER ORDER THINKING SKILLS

1. Why primary market is also known as new issue market? Give one reason.

Answer. When an entrepreneur decides to issues securities like shares, debentures to the public for the first time for the purpose of obtaining capital funds such issues of securities are even referred as “new money issues”. Primary market is known as new issue market.

SECTION-C: STOCK EXCHANGE

A. VERY SHORT ANSWER TYPE QUESTIONS

1.What are the responsibilities of governing body?

Answer. The governing body is responsible for policy formulation and proper functioning of the exchange, having wide range of powers:

- Elect the office bearers and set up committees

- Interpret rules, regulations and by-laws

- Admit and expel members

- Adjudicate disputes

- Manage the properties and finance of the exchange

- Conduct the affairs of the exchange.

2.Name the stock exchanges where most of the stock trading in India is done.

Answer. Most of the stock trading in India is done on NSE and BSE.

The BSE is the Bombay Stock Exchange and the NSE is the National Stock Exchange.

The BSE is situated at Bombay and the NSE is situated at Delhi.

These are the major stock exchanges in the country.

3.What is a secondary capital market?

Answer. Any transaction in shares or debentures subsequent to its primary offering is called “Secondary Transaction”. Thus, the secondary capital market, which is also known as old securities market or stock exchange deals- with buying and selling of old securities i.e. the market securities issued earlier are sold by existing investors in this market.

B. SHORT ANSWER TYPE QUESTION

1.What is the alternate name of stock used by different people?

Answer. The word “stock” is called by different names with different people like shares, equity, scrip and so on but all these words have same meaning.

C. LONG ANSWER TYPE QUESTIONS

1.Explain the importance of Stock Exchange from the companies point of view.

Answer. From the companies point of view:

- Widespread market

- High share value

2.Explain the importance of Stock Exchange from the viewpoint of investors.

Answer. From the investor’s point of view:

- Dissemination of useful Information: It publishes useful information regarding price lists, quotations, etc., of securities through newspapers and journals.

- Ready Market: It will be easy way platform for all those for buying and selling shares and convert it into cash through a member of stock exchange.

- Investors’ Interests Protected: Stock exchanges formulate rules and regulations so that members may not exploit the investors.

- Genuine guidance about the securities listed.

- Barriers of distance removed.

- Knowledge of profit or loss on investments and ensures a measure of safety and fair dealings to the investors.

3.Explain the importance of Stock Exchange from the viewpoint of society.

Answer. From the societies point of view:

- Rapid Capital Formation

- Economic Development

- National Projects

4.Rahil (Finance) and Anushk (HR) are doing MBA (IIM Indore). While reading the newspaper Anushk saw the heading Sensex goes up. But last week the heading was different that Sensex goes down now some confusion was going on her mind, immediately she asked her Friend Rahil the same? Now according to you how Rahil will clear the confusion of Anushk? Explain and give some value points.

Answer. Rahil explains him in this way: The Sensex is an “index”.

An index is basically an indicator. It gives you a general idea about whether most of the stocks have gone up or most of the stocks have gone down.

The Sensex is an indicator of all the major listed companies of the BSE.

The BSE, is the Bombay Stock Exchange and the NSE is the National Stock Exchange. The BSE is situated at Bombay and the NSE is situated at Delhi. These are the major stock exchanges in the country.

If the Sensex goes up, it indicates that the prices of the stocks (shares) of most of the major companies on the BSE have gone up.

If the Sensex goes down, this tells you that the stock price of most of the major stocks on the BSE have gone down.

In this way Rahil cleared the confusion

of Anushk.

Value Points:

- Quest for knowledge

- Helpfulness

- Consideration for others

- Awareness of responsibility

- Readiness to cooperate

- Friendship.

D. VERY LONG ANSWER TYPE QUESTIONS

1.Write down the features of stock exchanges.

Answer.

- Association of persons: A stock exchange is an association of persons or body of individuals which may be registered or unregistered.

- Recognition from central government: Stock exchange is an organized market. It requires recognition from the Central Government.

- Market for securities: Stock exchange is a market, where securities of corporate bodies, government and semi-government bodies are bought and sold.

- Deals in second hand securities: It deals with shares, debentures, bonds and such securities already issued by the companies. In short, it deals with existing or second hand securities and hence it is called secondary market.

- Regulates trade in securities: Stock exchange does not buy or sell any securities on its own account. It merely provides the necessary infrastructure and facilities to its members and brokers who trade in securities. It regulates the trade activities so as to ensure free and fair trade.

- Allow dealings only in listed securities: In fact, stock exchanges maintain an official list of securities that could be purchased and sold on its floor. Securities which do not figure in the official list of stock exchange are called unlisted securities. Such unlisted securities cannot be traded in the stock exchange.

- Transactions effected only through members: All the transactions in securities at the stock exchange are effected only through its authorized brokers and members. Outsiders or direct investors are not allowed to enter in the trading circles of the stock exchange. Investors have to buy or sell the securities at the stock exchange through the authorized brokers only.

- Working as per rules: Buying and selling transactions in securities at the stock exchange are governed by the rules and regulations of stock exchange as well as SEBI Guidelines. No deviation from the rules and guidelines is allowed in any case.

- Specific location: Stock exchange is a particular market place where authorized brokers come together daily (i.e. on working days) on the floor of market called trading circles and conduct trading activities. The price of different securities traded are shown on electronic boards. After the working hours market is closed. All the working of stock exchange is conducted and controlled through computers and electronic system.

- Financial barometers: Stock exchanges are the financial barometers and development indicators of national economy of the country. Industrial growth and stability is reflected in the index of stock exchange.

2.Explain the functions of stock exchange.

Answer.Stock exchange performs a number of functions in respect of marketability of different types of securities for investors and borrowing companies. It’s important functions are:

- Continuous and ready market for securities:

• Stock exchange provides a central market for purchase and sale of securities.

• It provides ready and continuous outlet for buying and selling of securities.

• It facilitates and helps all buyers to buy and sell securities as and when they want. - Facilitates evaluation of securities:

• It is useful for the correct evaluation of industrial securities.

• It publishes price quotation of the shares of the companies that have been listed with them after thorough analysis of demand and supply position.

• This enables investors to know the true worth of their holdings at any time. - Checks on brokers: It checks and controls the activities of brokers and protect the investors from being deceived.

While dealing,’if any broker is found indulging in malpractices as overcharging or giving wrong information, his/her licence may be cancelled. - Provides safety and security in dealings:

• All activities of the stock exchange are controlled by the provisions of the Securities Control (Regulation) Act and this creates confidence in the mind of investors.

• Each and every dealings and transactions are conducted as per well defined rules and regulations, fraudulent practices stands checked effectively ensuring safety, security and justice in dealings. - Regulates company management: All listed companies in the stock exchange, compulsorily have to follow with rules and regulations of concerned stock exchange and work under the vigilance of their authorities.

E. HIGHER ORDER THINKING SKILLS

1.Stock exchange performs a number of functions in respect of marketability of different types of securities for investors and borrowing companies. Explain the important functions of stock exchanges.

Answer.

- Continuous and ready market for securities: Stock exchange provides a central market for purchase and sale of securities. It provides ready and continuous outlet for buying and selling of securities. Buyers and sellers strongly believe that they would be able to buy and sell securities as and when they want.

- Facilitates evaluation of securities: Stock exchange is useful for the evaluation of industrial securities. It publishes price quotation of the shares of the companies that have been listed with them after thorough analysis of demand and supply position. This enables investors to know the true worth of their holdings at any time.

- Checks on brokers: Stock exchanges control the activities of brokers and protect the investors from being deceived. Now, if any broker is found indulging in malpractices as overcharging or giving wrong information, his/her licence may be cancelled.

- Provides safety and security in dealings: Activities of the stock exchange are controlled by the provisions of the Securities Control (Regulation) Act and all this creates confidence in the minds of investors. As transactions are conducted as per well defined rules and regulations, fraudulent practices stands checked effectively ensuring safety, security and justice in dealings.

- Regulates company management: Listed companies have to comply with rules and regulations of concerned stock exchange and work under the vigilance of stock exchange authorities.

- Intensifying capital formation: Stock exchange accelerates the process of capital formation through creating the habit of saving, investing and risk taking among the investing class by converting their savings into profitable, safe investments.

- Facilitates raising of new capital:Because of stock exchange, for either development, organisation or expansion, the need for more capital by the existing companies is easily met out.

- Facilitates public borrowing:Stock exchange serves as a platform for marketing government securities. It enables government to raise public debt easily and quickly.

- Facilitates healthy speculation: Healthy speculation keeps the exchange active. Normal speculation is not dangerous but provides more business to the exchange. However, excessive speculation is undesirable as it is dangerous to investors and the growth of corporate sector.

- Serves as economic barometer: Stock exchange indicates the state of health of companies and the national economy. It acts as a barometer of the economic situation/conditions and is thus referred to as ‘pulse of economy’ or ‘economic mirror’.

- Facilitates bank lending: Banks easily know the prices of quoted securities. They offer loans to customers against corporate securities. This gives convenience to the owners of securities.

SECTION-D: SEBI AND OTHERS

A. VERY SHORT ANSWER TYPE QUESTIONS

1.What do you mean by stock exchange?

Answer.A stock exchange means anybody of individuals, whether incorporated or not, constituted for the purpose of assisting, regulating or controlling the business of buying and selling or dealing in securities,

2.What is SEBI?

Answer. The Securities and Exchange Board of India or SEBI is the regulator for the securities market in India. It was established on 12 April, 1992 through the SEBI Act, 1992.

3.State three functions of SEBI rolled into one body.

Answer. SEBI has three functions rolled into one body: quasi-legislative, quasi-judicial and quasi-executive.

4.“Humorously, they were once given the acronym FFF for Angel Investors”. What does FFF stand for?

Answer. Friends, Family and Fools.

5.What do you understand by angel investors?

Answer. Business angel or informal investor or an angel investor, is an individual who provides capital for a business start-up and early stage companies in exchange for convertible debt or ownership equity.

B. SHORT ANSWER TYPE QUESTIONS

1.What is SEBI and what is its role?

Answer. The Securities and Exchange Board of India or SEBI is the regulator for the securities market in India.

Role of SEBI:

- It is a supervising and regulatory body to check certain malpractices and works for promoting the securities markets in India.

- It has three functions rolled into one body: quasi-legislative, quasi-judicial and quasiexecutive.

- It drafts regulations in its legislative capacity, it conducts investigation and enforcement action in its executive function and it passes rulings and orders.

2.Who manages SEBI?

Answer. SEBI is managed by its members, which consists of following:

- Chairman who is nominated by Union Government of India.

- Two members, i.e. Officers from Union Finance Ministry.

- One member from Reserve Bank of India.

- The remaining 5 members are nominated by Union Government of India, out of them at least 3 shall be whole-time members.

3.Explain briefly the three functions of SEBI rolled into one body.

Answer. SEBI has quasi-legislative capacity as it makes rules and regulations. It has rule-making authority related to the matters of securities in India.

SEBI is a quasi-judicial body as it has an entity such as an arbitrator or tribunal board, and has powers and procedures resembling those of a court. SEBI is quasi-executive as it functions like an executive but that is not really an executive.

4.What do you understand by venture capital?

Answer.

- Venture capital is a type of private equity capital provided as seed funding to early-stage.

- The investors provide funds to give shape to their ideas.

- It aims at avoiding death of an enterprise even before they could be tried.

- This investment enables the investors to accomplish objectives, in return for minority shareholding in the business or the irrevocable right to acquire.

- It is more accurate to view venture capital broadly as a professionally managed pool of equity capital.

- It is a way by which investors support entrepreneurial talent with finance and business skills for obtaining long-term capital gains.

5.Enlist several categories of financing possibilities in which smaller ventures sometimes rely on.

Answer. Following are several categories of financing possibilities in which smaller ventures sometimes rely on:

- Venture capital

- Seed Capital Finance

- Start up finance

- Loan from various financial institutions like, IDBI, SIDBI, IFCI, ICICI, NABARD, IIBI, SFCs, TFCI, AND SIDC.

6.Why are venture capitalists typically very selective in deciding while doing the investment?

Answer.

- Venture capital involves high risk as its is done for entrepreneurs who lack the necessary experience and funds to give shape to their ideas.

- The proposal of a new venture involves new or untried technology put forward by professionally or technically qualified persons involving high risk factors. This may fail to attract investments from public, which may result in their death even before they could be tried.

- Also the investments of venture capitalists are illiquid and require the time period to give returns. Venture capitalists thus have to carry out detailed due diligence prior to investment.

C. LONG ANSWER TYPE QUESTIONS

1.Explain the powers SEBI has been vested with for discharging of its functions efficiently.

Answer. SEBI has been vested with the following powers:

- To make and approve by-laws of stock exchanges.

- To enquire the stock exchange to amend their by-laws.

- Inspect the books of accounts and call for periodical returns from recognized stock exchanges.

- Inspect the books of accounts of financial intermediaries.

- Compel certain companies to list their shares in one or more stock exchanges.

- Levy fees and other charges on the intermediaries for performing its functions.

- Grant license to any person for the purpose of dealing in certain areas.

- Delegate powers exercisable by it.

- Prosecute and judge directly the violation of certain provisions of the Companies Act.

- Power to impose monetary penalties.

2.What are the features of venture capital finance?

Answer. Venture capital finance has the following features:

- Equity: It is equity finance in relatively new ventures and new companies.

- Long term: It is long-term investment in growth-oriented small or medium firms.

- Skills: Venture capitalist also business skills to investee firms. This raises the chances of success of the emerging firm.

- Risk: It involves high risk-return spectrum.

- Private equity: It is a subset of private equity.

- Involvement: The venture capital institutions make a continuous involvement in the business.

3.When can an entrepreneur seek venture capital financing?

Answer. An entrepreneur seeks venture capital financing under following circumstances:

- High risk: Ventures which involve high risk due to various reasons like technological, creativity and innovation, etc. are subjected to high risk related to returns. Here the venture capitalist comes forward.

- Seed funding: Seed money, is a form of securities offering in which an venture investor purchases part of a business. Interest of the venture capitalist for purchase of security is also a reason.

- Expansion: If the entrepreneur wants to expand then he goes for venture capital.

- Business skills: Lack of business skills also forces the entrepreneur to go for venture capital.

D. VERY LONG ANSWER TYPE QUESTION

1.Explain the characteristics of angle investors.

Answer. Following are the characteristics of angle investors:

- High net worth: Most angle investors are current or retired executives, business owners, etc. They have the knowledge, expertise, and funds to help start-ups.

- High risk: Angle investors bear extremely high risk. They expect a very high return on investment which they are making.

- Guidance: Most angle investors provide proactive advice, guidance, or mentoring services for the start-ups in its early days of the enterprises.

- High returns: Angle investors also have objective to create successful companies by providing value creation, and guiding investors realize a high return on investments.

- Experience: Angle investors have a sharp inclination to keep themselves updated to current developments in a particular business area and then mentor another group of entrepreneurs by making use of their precious experience.

- Type of Investments: Most angles invest in small, start-up businesses with fewer employees. The arrangements are informal.

- An individual investor: Angle investors are usually individuals.

E. HIGHER ORDER THINKING SKILLS

Question 2.Why it is said that “A venture capitalists investments are illiquid”. Give reason.

Answer. Illiquid describes an asset or security that cannot be sold quickly. Uncertainly the asset value is associated with the investment. This can be due to economic instability or issues relating to the asset. If the asset value declines, it becomes an illiquid asset due to the unclear value. It can be hard to locate a market for these products. This may lead to loss of the money.

SECTION-E: SPECIALISED FINANCIAL INSTITUTIONS

A. VERY SHORT ANSWER TYPE QUESTIONS

1.What is the role of Specialized Financial Institutions in India?

Answer.

- The role of Specialized Financial Institutions (SFIs) also called development banks make an important source of medium and long-term financing amongst all the financial institutions in India.

- They generally provide finances to the business and they help in promotion of new industries/new entrepreneur.

2.Enumerate the types of Specialised Financial Institutions from where entrepreneur can access capital according to their need and requirements.

Answer.A. At national level/All India development banks

- Industrial Development Bank of India (IDBI)

- Small Industries Development Bank of India (SIDBI)

- Industrial Finance Corporation of India (IFCI)

- Industrial Credit and Investment Corporation of India (ICICI)

- National Bank for Agriculture and Rural Development (NABARD)

- Industrial Investment Bank of India Ltd. (IIBI)

B. At state level

- State Financial Corporation (SFCs)

- Tourism Finance Corporation of India (TFCI)

- State Industrial Development ,Corporations (SIDC)

3.When was SIDBI established?

Answer. SIDBI was established in April 1990, as a wholly owned subsidiary of IDBI, under the Small Industries Development Bank of India Act, 1990.

B. SHORT ANSWER TYPE QUESTIONS

1.Explain the need and importance of Specialized Financial Institutions in India.

Answer. As SFIs provide developmental finance, that is, finance for investment in fixed assets, they are also known as ‘development banks’ or ‘development financial institutions’. Establishing of SFIs facilitated:

- Provision of sufficient long-term funds in the desired sectors in accordance with planned priorities to the industrial units and entrepreneurs.

- New and small entrepreneurs in setting up industry.

- Development of: (i) Small scale industry, and (ii) Projects in backward areas.

- Provision of technical and managerial advice to the entrepreneurs, facilitating thus, in identification, evaluation and execution of new investment enterprises.

- Underwriting of and direct subscription to the issue of shares and debentures in the capital market of the upcoming ventures.

- Establishment of enterprises which require extraordinarily large amount of finance for their projects with a long-gestation period.

2.Explain the objectives and functions of SIDC.

Answer.

- SIDCs: The State Industrial Development Corporations (In-corporated under the Companies Act, 1956) were set up in different states as state government as companies wholly owned by them, the main objectives of SIDCs was promoting industrial development in all states of the countries.

- At present, 22 such SIDCs are functioning in India.

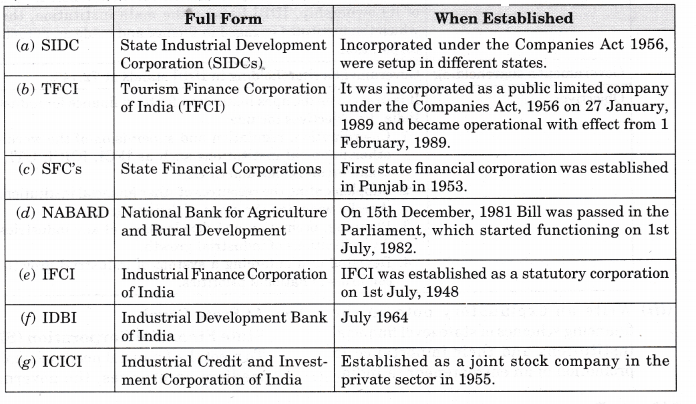

3.Write the full form of and when it was established.

(a)SIDC

(b) TFCI

(c) SFC’s

(d) NABARD

(e) IFCI

(f) IDBI

(g) ICICI

Answer.

C. LONG ANSWER TYPE QUESTIONS

1. Apoorva wants to start a new business near to her locality, for which she requires capital. State different types of national level and state level financial institutions from where Apoorva can access capital according to her needs and requirements.

Answer. Types of Specialised Financial Institutions: Entrepreneurs have access to any of the following SFIs to choose from, according to their needs and requirements:

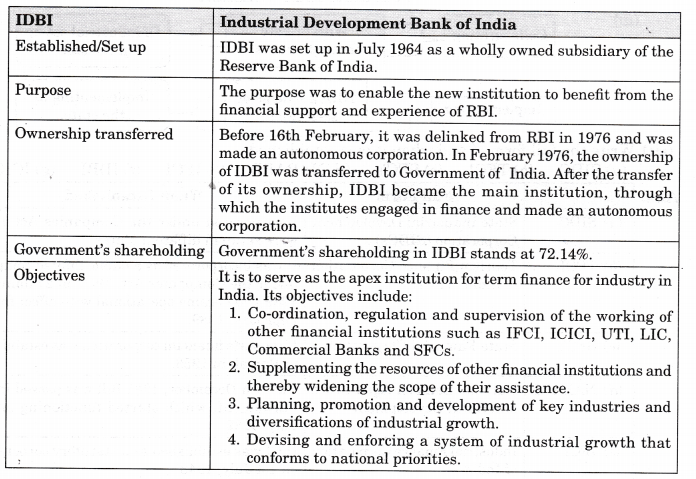

2.Write down the objectives of IDBI.

Answer. The main objectives of IDBI:

3.Write an explanatory note on the financing schemes of state level financial institutions and their importance in promotion of an entrepreneur in India.

Answer.At State Level State Financial Corporation (SFCs):

To meet the financial needs of small and medium enterprises, the government

of India passed the State Financial Corporation Act in 1951, empowering the state governments to establish development banks for their respective I regions. There are 18 SFCs at present.

Objectives: The objectives of State Financial Corporations are as under:

- Provide financial assistance to small and medium industrial concerns.

These may be from corporate or co-operative sectors as in case of IFCI or may be partnership, individual or Joint Hindu family business,

engaged not only in the manufacture, preservation or processing of goods. - Provide long and medium-term loan repayment ordinarily within a period not exceeding 20 years.

- Grant financial assistance to any

single industrial concern under corporate or co-operative sector with an aggregate upper limit of r rupees Sixty lakhs. In any other case(partnership, sole proprietorship or Joint Hindu family) the upper limit is rupees thirty lakhs. - Provide financial assistance generally to those industrial concerns whose paid up share capital and free reserves do not exceed Rs 3 crore.

- To lay special emphasis on the development of backward areas and small scale industries.

Functions:

- Grant of loans and advances to or subscribe to debentures of, industrial concerns repayable within a period not exceeding 20 years.

- Guaranteeing deferred payments due from an industrial concern for purchase of capital goods in India.

- Underwriting of the issue of stock, bonds or debentures by industrial concerns.

- Subscribing to, or purchasing of, the stock, shares, bonds or debentures of an industrial concern subject to a maximum of 30 per cent of the subscribed capital, or 30 per cent of paid up share capital and free reserve, whichever is less.

- Act as agent of the Central government, State government, IDBI, IFCI or any other financial institution in the matter of grant of loan or business of IDBI, IFCI or financial institution. Tourism Finance Corporation of India (TFCI): The Tourism Finance Corporation of India (TFCI) was born as a result of the Government of India’s decision, in 1987, to promote a separate all- India financial institution for providing financial assistance to tourism-related activities/projects.

Functions:

- TFCI provides financial assistance to enterprises for setting up or the development of tourism-related projects, facilities and services such as hotels, restaurants, holiday resorts, amusement parks, entertainment centres, education and sports, rope ways, cultural centres, convention halls, transport, travel and tour operating agencies, air services, tourism emporia and sports facilities.

- It also provides advisory and merchant banking services in this field.

- The projects with a capital cost of Rs 1 crore or above are generally eligible for assistance from TFCI. Smaller projects would also be considered.

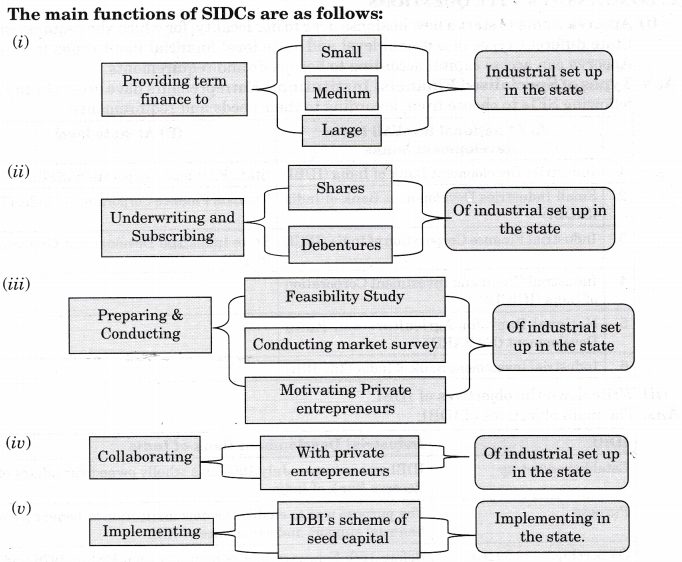

State Industrial Development Corporation (SIDCs): Incorporated under the Companies Act, 1956 SIDCs were set up in different states as wholly owned companies for promoting industrial development in their respective states. The main functions of SIDCs are as follows:

- Providing term finance to all small, medium, and large industrial enterprises set up in the state.

- Underwriting and directly subscribing to shares, and debentures of industrial enterprises being set up in the state.

- Preparing feasibility studies, conducting market surveys and motivating private entrepreneurs to set up their industrial ventures in the state.

- Collaborating with private entrepreneurs to set up industrial ventures in joint and assisted sectors.

- Implementing IDBI’s scheme of seed capital in the state.

Finance can be procured, just like any other resource, against a cost. Procurement of finance involves risk and formalities to comply with. Entrepreneurs need a careful attitude, to sensibly make a choice of sources to generate funds. No one source can be deemed to be the best source. Thus, it is always advisable to select a combination of sources so that both cost and risk can be kept at lowest.

- Tourism Finance Corporation of India (TFCI)

- State Industrial Development Corporations (SIDC)

4.Write a short note on IIBI.

Answer. Industrial Investment Bank of India Ltd. (IIBI): The Industrial Investment Bank of India Ltd. (IIBI) was formed by transforming the Industrial Reconstruction Bank of India (IRBI). It was set up by IDBI at the instance of the Government of India in April 1971 for rehabilitation of sick industrial companies. IRBI was incorporated under the Companies Act, 1956 and renamed as the Industrial Investment Bank of India Ltd. in March 1997.

Functions: IIBI offers a wide range of products and services such as:

- Term-loan assistance for project finance

- Short duration non-project asset – backed financing working capital/ other short term loans to companies

- Equity Subscription Asset Credit

- Equipment finance

- Investments in Capital Market and Money market instruments.

5.Describe the form of assistance provided by SIDBI to the industrial concern.

Answer. The financial assistance of SIDBI to the small scale sector is channelised through the following two routes:

- Indirect Assistance: Under its indirect schemes, SIDBI extends refinance of loans to small scale sector by Primary Lending Institutions (PLIs) viz. SFCs, SIDCs and Banks. At present, such refinance assistance is extended to 892 PLIs and these PLIs extend credit through a net work of more than 65,000 branches all over the country. All the Schemes of SIDBI both direct and indirect assistance are in operation in all the States of the country through 39 regional/branch offices of SIDBI.

- Direct Assistance: SIDBI directly assists SSIs under:

• Project Finance Scheme

• Equipment Finance Scheme

• Marketing Scheme

• Vendor Development Scheme

• Infrastructural Development Scheme

• ISO-9000

• Technology Development & Modernisation Fund.

D. VERY LONG ANSWER TYPE QUESTIONS

1.Explain the main objectives and functions of ICICI.

Answer. The ICICI has been established to achieve the following objectives:

- To assist in the formation, expansion and modernization of industrial units in the private sector.

- To stimulate and promote the participation of private capital (both Indian and foreign) in such industrial units.

- To furnish technical and managerial aid so as to increase production and expand employment opportunities.

2.Explain in detail objectives and three important Primary functions ofNABARD.

Answer. National Bank for Agriculture and Rural Development (NABARD): On 15th December, 1981, National Bank for Agriculture and Rural Development (NABARD) Bill was passed in the Parliament, which started functioning on 1st July, 1982. NABARD was established according to the Preamble to the Act, for providing credit for the promotion of:

- Agriculture

- Small-scale Industries

- Cottage and Village Industries

- Handicrafts and other rural crafts

- Other economic activities in rural areas with a view for promoting IRDP.

Objectives:

- The bank will serve as a financing institution for institutional credit such as long-term, short-term, and for the promotion of activities in rural areas.

- To provide direct lending to any institution as may be approved by the central government.

Functions: The primary functions of NABARD can be classified under three heads:

- Credit Functions: NABARD provides different types of refinance to eligible institutions. They assist entrepreneurs through:Short-term credit to State Cooperative Banks, Regional Rural Banks and Other financial institutions approved by RBI.

- Developmental Functions:

• NABARD coordinates the operations of rural credit institutions.

• It develops expertise to deal with agricultural and rural problems so as to assist in rural development efforts. - Regulatory Functions:

• NABARD is empowered to undertake inspection of RRBs and Cooperative Banks, other than the Primary Cooperative Banks.

• Toopenanew branch, arecommendation ofNABARD is imperative by RRBs or Cooperative Banks to seek permission from RBI.

E.HIGHER ORDER THINKING SKILLS

1.“TFCI is playing vital role in the development of entrepreneurship in modern economy”. Comment.

Answer.The Tourism Finance Corporation of India (TFCI) was born as a result of the Government of India’s decision, in 1987, to promote a separate all- India financial institution for providing financial assistance to tourism-related activities/projects.

It was incorporated as a public limited company under the Companies Act, 1956 on 27 January, 1989. It became operational with effect from 1 February, 1989.It is a specialized all-India development financial institution to cater to the needs of the tourism industry.

Functions:

- It provides financial assistance to enterprises for setting up or the development of tourism- related projects, facilities and services such as hotels, restaurants, holiday resorts, amusement parks, entertainment centres, education and sports, rope ways, cultural centres, convention halls, transport, travel and tour operating agencies, air services, tourism emporia and sports facilities.

- It provides advisory and merchant banking services in this field.

- The projects with a capital cost of Rs 1 crore or above are generally eligible for assistance from TFCI. Smaller projects would also be considered.

(d) TFCI has sanctioned assistance to 2003 projects aggregating to Rs 5.2 billion during the last five years, resulting in more than 12,217 hotel rooms and direct employment to 22,938 people.

Values:

- Universal and equality

- Resourcefulness

- Services to others

- Readiness to cooperate

- National awareness

- Employment opportunities

- Fulfilling the needs of the people

- Helpfulness and contributing to entrepreneur for the growth of the country.

3. Hari is an entrepreneur who wants to start an amusement park in Indore. He knows that she needs a huge amount of initial capital. According to you, which of the financial institution will be more suitable to him? Suggest and Explain why?

Answer. Accordingly Hari should approach to Tourism Finance Corporation of India (TFCI), the financial institution.

TFCI is playing vital role in the development of entrepreneurship in modern economy. The Tourism Finance Corporation of India (TFCI) was born as a result of the Government of India’s decision, in 1987, to promote a separate all-India financial institution for providing financial assistance to tourism-related activities/projects.It was incorporated as a public limited company under the Companies Act, 1956 on 27 January, 1989.It became operational with effect from 1 February, 1989. It is a specialized all- India development financial institution to cater to the needs of the tourism industry.

The various functions:

- It provides financial assistance to enterprises for setting up or the development of tourism- related projects, facilities and services such as hotels, restaurants, holiday resorts, amusement parks, entertainment centres, education and sports, rope ways, cultural centres, convention halls, transport, travel and tour operating agencies, air services, tourism emporia and sports facilities.

- It provides advisory and merchant banking services in this field.

- The projects with a capital cost of? 1 crore or above are generally eligible for assistance from TFCI. Smaller projects would also be considered.

Values:

- Providing employment opportunities

- Cater to the financial needs of the tourism industry.

- To protect national property.

- Awareness of responsibility of citizenship

- Initiative

- Proper utilization of time and resources.

3.Assuming that you wish to start a small scale industry for manufacturing and selling detergent powder, discuss how would you seek support of financial institutions.

Answer. Yes, to start with a small scale industries for manufacturing and selling is really a tough job in this competitive world where already many other detergent manufacturing units are there. Detergents are also known as synthetic detergents. They are different from oil-based soap though both soaps and detergents are surfactants. There are a number of varieties of detergents varying in percentages of active matter present in them and also different colours. Manufacturing process is very simple and only mixing is involved. Hence, this product is best suited for manufacturing in small-scale sector.

An entrepreneur can seek support from various financial institutions and others.

- Angle Investors:

• Business angle or an angle investor is an affluent individual who provides capital for a business start-up and early stage companies having a high- risk, high-return matrix usually in exchange for convertible debt or ownership equity.

• Apart from investing funds, most angles provide proactive advice, guidance, industry connections and mentoring start-ups in its early days. - Venture Capitalist:

• Venture capital is an equity based investment in a growth-oriented small to medium business to enable the investors to accomplish objectives, in return for minority shareholding in the business or the irrevocable right to acquire.

• The private equity capital provided as funding to early-stage, high potential, high risk, growth up companies/entrepreneurs who lack the necessary experience and funds to give shape to their ideas.

• Accordingly, it is more accurate to view and go for venture capital broadly as a professionally managed pool of equity capital.

• Venture capital is a way in which investors support entrepreneurial talent with finance and business skills to exploit market opportunities and obtain long-term capital gains.

State Financial Corporations (SFCs):

- It will be to meet the financial needs of small and medium enterprises, established as development banks for their respective regions. Under the Act, SFCs have been established by state governments to meet the financial requirements of medium and small sized enterprises. There are 18 SFCs at present. According to the location I can easily approach the same.

- Grant of loans and advances to or subscribe to debentures of, industrial concerns repayable within a period not exceeding 20 years.

- Guaranteeing loans raised by industrial concerns which are repayable within a period not exceeding 20 years.

- Guaranteeing deferred payments due from an industrial concern for purchase of capital goods in India.

4.Discuss the advantages and disadvantages of financial institutions for an entrepreneur.

Ans.Advantages of financial institutions for an entrepreneur

- Borrowing money from the bank is one of the simplest ways to get needed funds to start or grow your business.

- To grant loans and advances.

- To underwrite or to subscribe to shares or debentures of industrial concerns.

- To guarantee loans raised by industrial concerns in the market.

- To provide consultancy and merchant banking services in or outside India.

- To provide technical, legal, marketing and administrative assistance to any industrial concern or person for promotion, management or expansion of any industry.

- Co-ordination, regulation and supervision of the working of other financial institutions such as IFCI, ICICI.

- To act as trustee for the holders of debentures or other securities.

- To provide long and medium-term credit to industrial concerns engaged in manufacturing, mining, shipping and electricity generation and distribution.

- The bank will serve as a financing institution for institutional credit such as long-term, short-term, and for the promotion of activities in rural areas.

- Provides financial assistance to enterprises for setting up or the development of tourism-related projects.

Disadvantages: Procurement of finance involves risk and formalities to comply:

- State Financial Corporations only provide long and medium-term loan repayment ordinarily within a period not exceeding 20 years.

- Some financial institutions provide financial assistance generally to those industrial concerns whose paid up share capital and free reserves do not exceed Rs 3 crore.

- Rate of interest is too high sometimes not able to pay the debt amount and its interest.

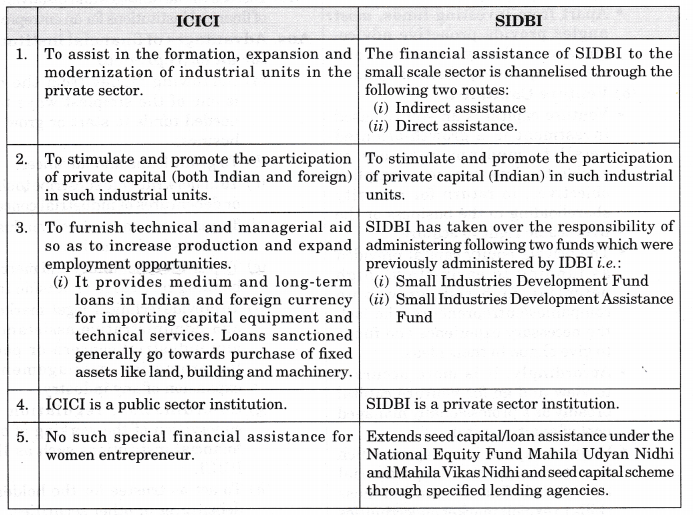

5.Distinguish between ICICI and SIDBI.

Answer.

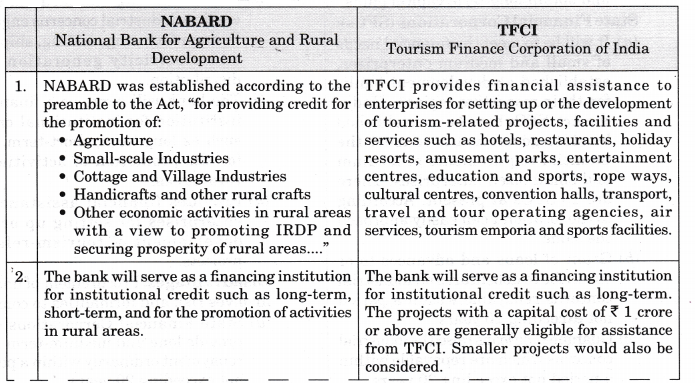

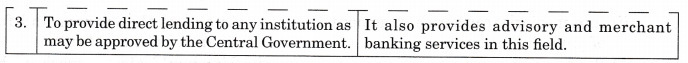

6.How NABARD is different from TFCI?

Answer.

7.Company A goes for public issue of 10,000 shares @ Rs 10 each. Application were received for only 5,000 shares. Can the company proceed with the process of issuing shares?

Answer. In the case of Company A

Issued shares to public — 10,000 Shares @ 10 each.

Applied share public by — 5,000 Shares @ 10 each.

Company receives only 50% of the subscription within 120 days from the date of the issue, then it is called as Minimum subscription.

As per the SEBI guidelines, if the company does not receive 90% of the issue amount from the public subscription including development from underwriters within 120 days from the date of the issue, the amount of subscription received is required to be refunded to the applications. In case of disputed development also, subscription is required to be refunded if 90% of the issued amount plus accepted. Development from underwriters if any is not received within 120 days of the issue of prospectus, all the money received from the applicants for shares is required to be repaid forthwith without interest and if any such money is not so repaid in the next 10 days (after the expiry of 120 days), the directors of the company are jointly and severally liable to repay that money, with interest from the expiry of the 130 days.

The company should refund the amount within 10 weeks of the closing of the subscription list and pay interest, if refunds are delayed by more than 8 days after this period.

VALUE BASED QUESTIONS

Question 1. Harish is working as the chief accountant in ABC infrastructure Ltd. He came to It also provides advisory and merchant banking services in this field.know that the company is planning to announce an interim dividend. He purchased 2000 shares of the Co. at the market price of ? 215 with the expectation of an appreciation in the market price. When the price increased to ^ 537 he sold his holdings & made a handsome profit. Name the related concept which social values have been affected here?

Answer. Before deciding right or wrong conduct of a chief accountant let us understand what is interim dividend, role of a chief accountant, his conduct for his benefit and affected social values.

- Interim dividends are dividend payments made before a company’s Annual General Meeting (AGM) and final financial statements. This declared dividend usually accompanies the company’s interim financial statements.

- As a chief accountant of a company he should not disclose confidential information which might be acquired in course of his work during the meeting time and he should not even use such information for his personal gain or gain for others.

- The above case study is concerned with unethical behaviour done by the chief accountant.

- Affected social values are trust, honesty, duty, loyalty and truthfulness.

Question 2. By offering shares to its employers what values are promoted by a company.

Ans. Offering shares for sale to its employers means firstly new securities are offered to an intermediary at a fixed price then it is further resold to general public at a higher price.

Following values are promoted by a company:

- Self existent.

- Intermediaries can earn high amount of profits in future.

- Readiness to cooperate.

- Free from the tedious work of making public issue.

- Encouraging them for saving.

- Building a trust.

- It helps easily and directly in capital formation of the company.

- It is an easy method raising funds.

- Helpfulness.

- Faithfulness for utilization of their money.

Question 3.Mr. B the financial Manager of ABC Company purchases 100 shares of the Company just before the rights issue was announced. Is the behaviour of the manager ethical? What would you do as a legal advisor of the company?

Answer.

- Yes, the behaviour of the manager is unethical because rights issue is a method of raising additional finance from existing shareholders by offering securities to them on prorate basis i.e. giving them a right to a certain number of shares in proportion to the shares they are holding.

- As a legal advisor of the company, I advice that he should not be given that right of extra shares.

- As a manager his responsibility is to develop and analyse information

MORE QUESTIONS SOLVED

I. VERY SHORT ANSWER TYPE QUESTIONS

Question 1. What do you mean by “Financial Intermediation”?

Answer. The role of transferring financial resources from the surplus units to the deficit units is referred to as “Financial Intermediation”.

Question 2. Who plays a very vital role in a financial intermediatary.

Answer.Capital markets play a very vital role in a financial intermediatary.

Question 3. Identify the logo given below.

Answer. IDBI Bank.

Question 4. Name one of the financial institutions guaranteeing loans raised by Industrial concerns which are repayable within a period not exceeding 20 years.

Answer. State Financial Corporations (SFCs) guaranteeing loans raised by industrial concerns which are repayable within a period not exceeding 20 years.

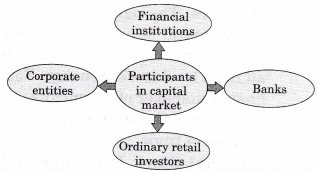

Question 5. List any four participants in capital market.

Answer.

Question 6.Name one financial institution which was formed by transforming The Industrial Reconstruction Bank of India.

Answer. The Industrial Investment Bank of India Ltd. (IIBI) was formed by transforming The Industrial Reconstruction Bank of India (IRBI).

Question 7. Name one financial institution which was set up by IDBI at the instance of the Government of India in April 1971 for rehabilitation of sick industrial companies.

Answer. Industrial Investment Bank of India Ltd. (IIBI) was set up by IDBI at the instance of the Government of India in April 1971 for rehabilitation of sick industrial companies.

Question 8. Name one financial institution which can sanction amount to a single concern i.e. minimum amount Rs. 5 lakhs and it does not go beyond the maximum limit of Rupees one crore.

Answer.Industrial Credit and Investment Corporation of India (ICICI).

Question 9. Name one financial institution which extends seed capital/loan assistance under the National Equity Fund, Mahila Udyan Nidhi and Mahila Vikas Nidhi.

Answer. Industrial Finance Corporation of India (IFCI).

Question 10. Name one of the financial institutions guaranteeing loans raised by industrial concerns which are repayable within a period not exceeding 25 years.

Answer. Industrial Finance Corporation of India (IFCI)

Question 11. Why stock exchange is called as the ‘financial barometers’ and development indicators of national economy?

Answer. Stock exchanges are the financial barometers and development indicators of national economy of the country. Industrial growth and stability is reflected in the index of stock exchange.

Question 12. By which act the organisation, management, membership and functioning of stock exchanges in India are governed?

Answer.The organisation, management, membership and functioning of stock exchanges in India are governed by the provisions of The Securities Contracts (Regulation) Act, 1956.

Question 13. Name the market which enhances the marketability of securities and thereby provides liquidity to investments.

Answer. The secondary market enhances the marketability of securities and thereby provides liquidity to investments.

Question 14. Who are in need of the help of capital markets?

Answer. The help of capital market is for:

- Industry

- Trade

- Finance

- Government.

Question 15. For what purpose the productive capital is raised?

Answer. Productive capital is raised and made available for industrial purposes.

Question 16. Mention two major instruments of capital market.

Answer.

- Equity Shares

- Debentures

Question 17. What is the other name of primary market?

Answer. New Issue Market (NIM).

Question 18. Name two methods of flotation of primary market.

Answer.

- Private Placement

- e-IPOs.

Question 19. Name the most popular method of raising funds by companies in the primary market.

Answer. Offering shares through prospects.

Question 20. Name two segments of capital market.

Answer.

- Primary market

- Secondary market.

Question 21. What do you mean by lease rent?

Answer. When assets are owned by ICICI but allowed to be used by industrial concerns for a consideration is called lease rent.

Question 22. Name two Indian stock market index.

Answer. SENSEX and NIFTY.

Question 23. Name two National Stock Exchanges.

Answer. NSE (National Stock Exchange of India) and OTCEI (Over the Counter Exchange of India)

Question 24. Name two regional stock exchanges.

Answer.

- Bombay Stock Exchange and

- Calcutta Stock Exchange.

Question 25. “ Internal sources are referred to as owner’s own money”. Give one alternate name for owner’s own fund.

Answer. Alternate name for owner’s own fund is also known as ‘equity’.

Question 26. Define Stock Exchange.

Answer. A stock exchange means anybody of individuals, whether incorporated or not, constituted for the purpose of assisting, regulating or controlling the business of buying and selling or dealing in securities. Securities Contracts (Regulation) Act, 1956.

Question 27. Name the institution which owned.an asset but allowed to be used by industrial concerns for a consideration called lease rent.

Answer. ICICI.

Question 28. Why is NSEI called a ringless stock exchange?

Answer. In traditional stock exchange securities are traded only by coming into a specified place called ring.But NSEI has not kept a particular place for trading/dealings in the transactions. All the transactions take place electronically or e-issues.

Question 29. What do you understand by listed securities?

Answer.When companies securities that are registered and traded in stock exchange are known as “Listed Securities”.

Question 30. Bhavin, Abhishek and Mohit are the directors of a newly established company at Indore. The paid-up capital equity share capital of a company is 4 crore, they are interested to trade its shares at all India level stock exchange. You are a finance manager of a company, suggest the name of the stock exchange for the purpose of trade.

Answer.National Stock Exchange of India (NSEI).

Question 31. What do you mean by capital market?

Answer. A capital market may be defined as an organized mechanism meant for effective and smooth transfer of money capital or financial resources from the investors to the entrepreneurs.

Question 32. What do you mean by primary market?

Answer. Primary market refers to the market where issue of securities (shares, debentures and bonds) being issued for the first time by new companies or new issue of securities by existing companies to investors. It is basically to facilitate transfer of resources from the savers to entrepreneur for seeking more funds.

Question 33. “SEBI is managed by its members”. How many members are there in SEBI and who nominate them?

Answer. SEBI is managed by its members

- Chairman who is nominated by Union Government of India.

- Two members, i.e. Officers from Union Finance Ministry.

- One member from The Reserve Bank of India.

- The remaining five members are nominated by Union Government of India, out of them at least three shall be whole-time members.

Question 34. Rahul wants to start an amusement park near Vishakhapatanam. This will require an investment of Rs 50 lakhs. Name the financial institution which Rahul should approach for financing this venture. [CBSE Delhi 2015]

Answer. Tourism Finance Corporation of India (TFCI).

Question 35. Geeta Ram, an orange grower from Nagpur, wants to start a small juice producing factory using the oranges grown by him as well as by his fellow villagers. Name the financial institutions he should contact for obtaining loan for starting his factory. [All India 2015]

Answer. Geeta Ram should contact National Bank for Agricultural and Rural development (NABARD) for starting his factory.

II.SHORT ANSWER TYPE QUESTIONS

Question 1. What is meant by ‘Capital Structure’?

Answer. It is the composition or mix of different types of long-term capital whether owned or borrowed. It includes all the long term funds consisting of share capital, debentures, bonds, loans and reserves.

Question 2. How does capital market satisfy firstly savers and at the same time investors ?

Answer. Capital market is a place where savers as well as investors get maximum satisfaction. The capital market satisfies the tastes of savers and the needs of investors through its various financial instruments and institutions. As per entrepreneurs requirement they enter either of the following markets available under capital market.

Question 3. What does the Securities Contracts (Regulation) Act, 1956 permit?

Answer. This Act permits only recognized stock exchanges to function under the rules, regulations and by-laws approved by the ‘ Central Government.

The organisation, management, membership and functioning of stock exchanges in India are governed by the provisions of The Securities Contracts (Regulation) Act, 1956.

Question 4. How do primary and secondary markets promote capital formation?

Answer. In the primary market the flow of funds is from savers to investors, that directly promotes capital formation. At the same time secondary market enhances the marketability of securities and thereby provides liquidity to investments. It indirectly promotes capital formation.

Question 5. For all entrepreneurs/all enterprises at all times, how different sources are differently related?