NCERT Solutions for Class 12 Accountancy Part II Chapter 3 Financial Statements of a Company

NCERT Solutions CBSE Sample Papers AccountancyClass 12 Accountancy

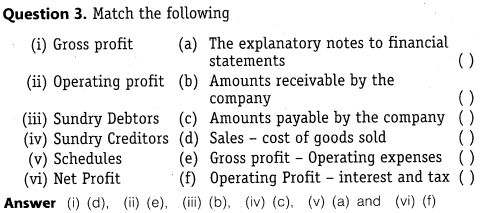

TEST YOUR UNDERSTANDING I

• State whether the following statements are true or false.

(a) Financial statements are the end products of accounting process.

Answer True

(b) Financial statements are primarily directed towards the needs of owners.

Answer True

(c) Facts and figures presented in financial statements are not at all based on personal judgements.

Answer False

(d) Recorded facts are based on replacement cost.

Answer False

(e) Going Concern concept assumes that the enterprise continues for a long-period of time.

Answer True

• Fill in the blanks with appropriate word(s)

(a) Financial statements are the—————of information to interested parties.

Answer Basic sources

(b) The owners of a company are called ———————

Answer Shareholders

(c) For income measurement—————–basis of accounting is followed.

Answer Accrual . .

(d) The statement which shows the assets and liabilities of a

company is known as—————-.

Answer Balance sheet

(e) Profit and loss account is also called————-statement.

Answer Income

TEST YOUR UNDERSTANDING II

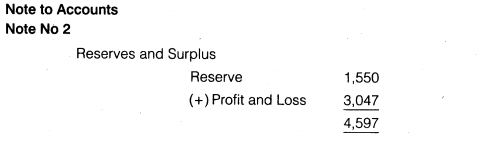

Question 1. What are the items shown under heading ‘Reserve and Surplus’?

Answer Capital Reserve, Capital Redemption Reserve, Securities Premium other reserves, profit and loss account.

Question 2. What are the items shown under heading ‘Miscellaneous Expenditure?

Answer Preliminary expenses, discount on Issue of share and debenture other deferred expenses and profit and loss account (debit balance).

SHORT ANSWER TYPE QUESTIONS

Question 1. State the nature of financial statements.

Answer Financial statements are the summarised reports of recorded-facts and are prepared following the accounting concepts, conventions and requirements of Law.

The American Institute of Certified Public Accountants states the nature of financial statements as, “the statements prepared for the purpose of presenting a periodical review of report on progress by the management and deal with the status of investment in the business and the results achieved during the period under review.

The following points explain the nature of financial statements

(i) Recorded Facts :Financial statements are prepared on the basis of facts in the form of cost data recorded in accounting books. The

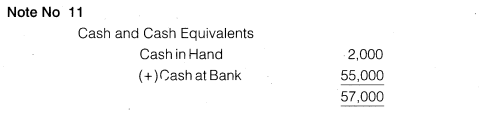

original cost or historical cost is the basis of recording transactions. The figures of various accounts such as cash in hand, cash at bank, bills receivable, sundry debtors, fixed assets, etc are taken as per the figures recorded in the accounting books.

The assets purchased at different times and at different prices are put together and shown at costs. As these are not based on market prices, the financial statements do not show current financial condition of the concern.

(ii) Accounting Conventions: Certain accounting conventions are followed

while preparing financial statements. The convention of valuing inventory at cost or market price, whichever is lower, is followed. The valuing of assets at cost less depreciation principle for balance sheet purposes is followed. •

The convention of materiality is followed in dealing with small items like penci’s, pens, postage stamps, etc. In this way the use of accounting conventions makes financial statements comparable, simple and realistic.

(iii) Based on Concepts: Financial statements are prepared on certain basic assumptions (prerequisites) known as Concepts such as going concern concept, money measurement concept, realisation concept, etc. Going concern concept assumes that the enterprise is treated as a going concern and exists for a longer period of time. So the assets are shown on historical cost basis.

Money measurement concept assumes that the value of money will remain the same in different periods. While, preparing profit and loss account the revenue is included in the sales of the year in which the sale was undertaken even though the sale price may be received over a number of years. The assumption is known as realisation concept.

(iv) Personal Judgements: Under more than one circumstance, facts and figures presented through financial statements are based on personal opinion, estimates and judgements.

The depreciation is provided taking into consideration the useful economic life of fixed assets. Provisions for doubtful debts are made on estimates and personal judgments. In valuing inventory, cost or market value, whichever is less is being followed.

Question 2. Briefly explain the importance of preparing financial statements.

Answer Significance of Financial Statement :The users of financial statements include Shareholders, Investors, Creditors, Lenders, Customers, Management, Government, etc. Financial statements help all the users in their decision-making process. They provide data about general purpose needs of these members.

The various uses and importance of financial statements are as follows

(i) Reporting to the Share Holders: Financial statements report the performance of the management to the shareholders. The gaps between the management performance and ownership expectations can be understood with the help of financial statements.

(ii) Basis for Fiscal Policies :The fiscal policies, particularly taxation policies of the government, are related with the financial performance of corporate undertakings. The financial statements provide basic input for industrial, taxation and other economic policies of the government.

(iii) Basis for Granting of Credit: Corporate undertakings have to borrow funds from banks and other financial institutions. for different purposes. Credit granting institutions take decisions based on the financial performance of the undertakings. Thus, financial statements form tfe basis for granting of credit.

(iv) Basis for Prospective Investors :The investors include both short-term and long-term investors. Their prime considerations in their investment decisions are security and liquidity of their investment with reasonable profitability. Financial statements help the investors to assess long term and short-term solvency as well as the profitability of the concern.

(v) Aids Trade Associations in Helping their Members: Trade associations may analyse the financial statements for the purpose of providing service and protection to their members. They may develop standard ratios and design uniform system of accounts.

(vi) Helps Stock Exchanges: Financial statements help the stock exchanges to understand the extent of transparency in reporting on financial performance and enables them to call for required information to protect the interest of investors.

Question 3. What are the limitations of financial statements?

Answer Financial statements are very useful to an organisation but still , they suffer from the following limitations

(i) Historical Data :Financial statements are prepared on the basis of historical cost. Since the purchasing power of money is changing, the values of assets and liabilities shown in financial statement do not reflect current market situation.

(ii) Assets May not Realise: Accounting is done on the basis of certain conventions. Some of the assets may not realise the stated values, if the liquidation is forced on the company. Assets shown in the balance sheet reflect merely unexpired or unamortised cost.

(iii) Bias: Financial statements are the outcome of recorded facts, accounting concepts and conventions used and personal judgments made in different situations by the accountants. Hence, bias may be observed in the results, and the financial position depicted in financial statements may not be realistic.

(iv) Aggregate Information: Financial statements show aggregate information but not detailed information. Hence, they may not help the users in decision-making much.

(v) Vital Information Missing: Balance sheet does not disclose information relating to loss of markets, and cessation of agreements, which have vital bearing on the enterprise.

(vi) No Qualitative Information: Financial statements contain only monetary information but not qualitative information like industrial relations, industrial climate, labour relations, quality of work, etc.

(vii) They are Only Interim Reports: Profit and loss account discloses the profit/loss for a specified period. It does not give an idea about the earning capacity over time similarly, the financial position reflected in balance sheet is true at that point of time, the likely change on a future date is not depicted.

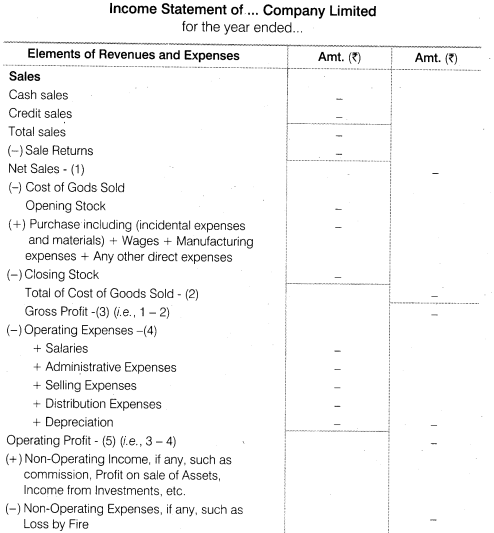

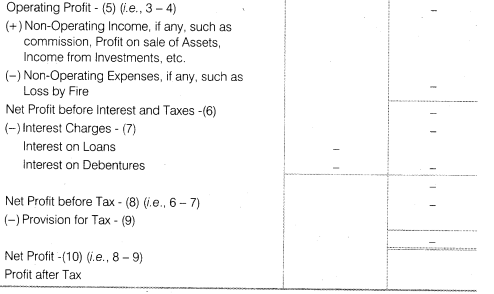

Question 4. Prepare the format of income statement and discuss its elements.

Answer Income statement may also be presented in vertical form with detailed data. This is considered more suitable for further analysis and providing necessary data for decision-making. The form and contents of vertical income statement is shown below (Vertical Form)

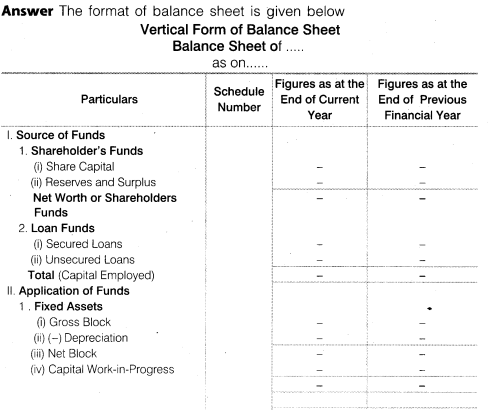

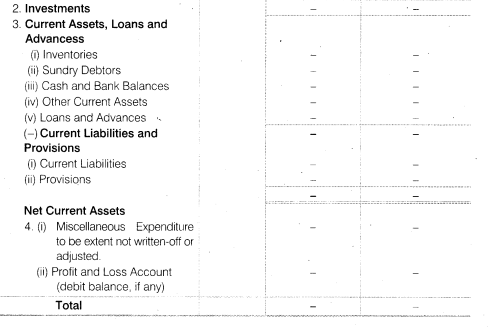

Question 5. Prepare the format of balance sheet and discuss its elements.

Elements of Balance Sheet: A brief description of various element of balance sheet is given below

Description of Elements at the Liabilities Side of Balance Sheet

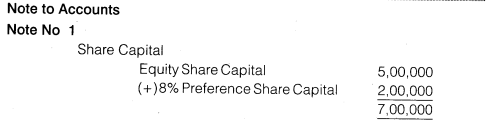

(i) Share Capital :This is the first thing which is being shown in the liabilities side of balance sheet. It consists of the following items

(a) Authorised Capital

(b) Issued Capital Equity share and preference share.

(c) Subscribed Capital less Call in Arrears add Forfeited Shares

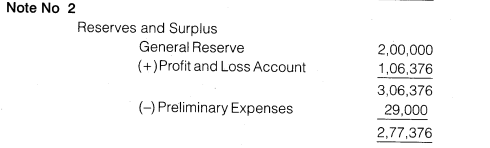

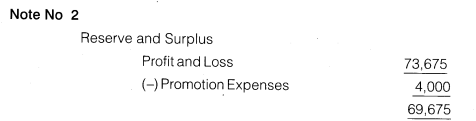

(ii) Reserve and Surplus: As per the Schedule VI, it consists of the following items

(a) Capital Reserve

(b) Capital Redemption Reserve

(c) Security Premium

(d) Other Reserve less Debit Balance of Profit and Loss account

(e) Surplus Credit Balance of Profit and Loss account

(f) Proposed Additions

(g) Sinking Fund

(iii) Secured Loans:

(a) Debentures

(b) Loan and advances from bank etc.

(iv) Unsecured Loans:

(a) Fixed Deposits

(b) Loan and Advances from subsidiaries

(v) Current Liabilities: Current Liabilities are those liabilities which are liable to pay with in an operating cycle generally one year; e.g., bank overdraft creditors, bills payable, outstanding wages, short term loans, etc are called current liabilities.

Description of Elements at the Liabilities Sfde of Balance Sheet

(i) Fixed Assets: These are those assets that are used for more than one year, like, Goodwill, Land and Building, Plant and Machinery, Motor Car, Patents, Trade Marks, Livestock etc.

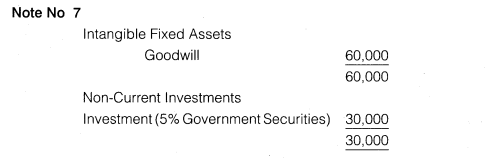

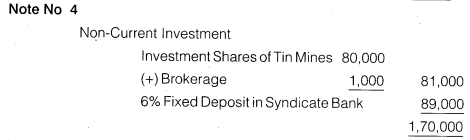

(ii) Investments :Under this head, various investments made such as investment in government securities or trust securities; investment in shares, debentures, and bonds of other companies, immovable properties, etc., are to be shown separately in the balance sheet.

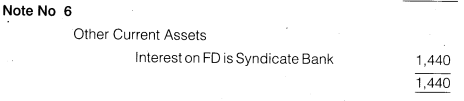

(iii) Current Assets: Assets which are converted into cash within an operating cycle is known as current assets. In other words current assets are required to run day to day business activities; e.g., cash, debtors, stock, etc.

(iv) Miscellaneous Expenditure: The expenditure which has not been written of fully its balance is shown under this heading. These expenses include preliminary expenses, advertisement expenditure, discount on issue of shares and debentures, share issue expenses, etc.

(v) Profit and Loss Account: When the Profit and Loss account shows a debit balance, i.e., loss which could not be adjusted against general reserves, the same is shown as a last item on the asset side.

LONG ANSWER TYPE QUESTIONS

Question 1. Explain how financial statements are useful to the various parties who are interested in the affairs of an undertaking?

Answer The various parties interested in financial statements directly or indirectly can be categorised in two broad categories

(i) Internal Parties: The following are the internal parties directly related to the company and interested in financial statements.

(a) Owner :The owner/s is/are interested in the profit earned or loss incurred during an accounting period. They are interested in assessing the profitability and viability of the capital invested by them in the business.

(b) Management: Management interested in financial statements for drafting various policies measures, facilitating planning and decision making process.

(c) Employees and Workers: The employee and workers are interested in financial statement for knowing about the timely payment of wages and salaries, bonus and appropriate increment in their wages and salaries. Financial statement enables them to know about the figure of profit earned during the year.

(ii) External Parties :There are various external parties who are interested in financial statements for a number of reasons.

The following are the various external parties.

(a) Creditors: Creditors are always interested in financial statement to gather information about credit worthiness of the business.

(b) Investors and Potential Investors: Persons who are willing to invest in any organisation always wish to know about the profitability and solvency of the business concern. Hence, in order to assess the viability and prospectus of their investment, creditors need information about profitability and solvency of the business.

(c) Consumers: The survival and growth of any organisation largely depends upon the Goodwill earned in the heart of the customers. In this regards if the Business has transparent financial records it help in assisting the customers to know the correct cost of production and accordingly assess the degree of reasonability of the price charged by the business.

(d) Banks/Financial Institutions: Banks and financial institutions provide finance in the form of loans and advances to various businesses. Thus, they need information regarding liquidity, creditworthiness, solvency and profitability to advance loans.

(e) Tax Authorities: They need information about sales, revenues, profit and taxable income in order to determine and levy various types of tax on the business.

(f) Government :It needs information to determine national income, GDP, industrial growth, etc. The accounting information assist the government in the formulation of various policies measures and to address various economic problems like employment, poverty etc.

(g) Researchers :Various research institutes like NGOs and other independent research institutions undertake various research projects and the accounting information facilitates their research work.

Question 2. Financial statements reflect a combination of recorded facts, accounting conventions and personal judgements. Discuss.

Answer The financial statements not only help in presenting the true and real financial position of the company but they also help in taking managerial decisions. The nature of the financial statements depends upon the following aspects like recorded facts, conventions, concepts and personal judgement.

(i) Recorded Facts: The items recorded in the financial statements reflect their original cost i.e., the cost at which they were acquired. Consequently, financial statements do not reveal the current market price of the items. Further, financial statements fail to capture the inflation effects.

(ii) Accounting Conventions: The preparation of financial statements is based on some accounting conventions like, Prudence Convention, Materiality Convention, Matching Concept, etc. The adherence to such accounting conventions makes financial statements easy to understand, comparable and reflects the true and fair financial position of the company. Besides the above while preparing financial statements, certain concepts are adhered to. The nature of these concepts is reflected in the nature of the financial statements.

(iii) Personal Judgements: The nature of financial statement largely depends upon the personal value judgements. Personal judgements are attached to different practices of recording transactions in the financial statements, e.g., recording stock either at market value or at the cost requires value judgement depending upon the personal judgement. Thus, personal judgements help in determining the nature of the financial statements.

Question 3. Explain the process of preparing income statement and balance sheet.

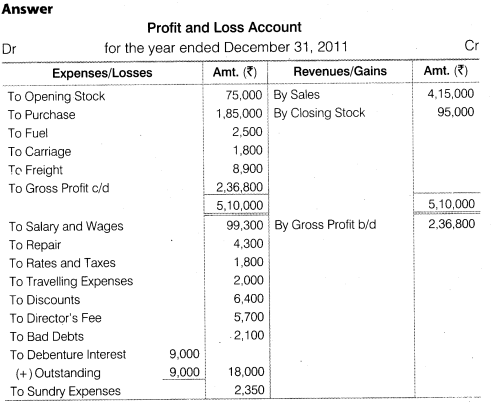

Answer The process of preparing income statement is explained below

(i) First of all a Trial Balance is prepared on the basis of the balances of various accounts in the ledger.

(ii) After that trading account is prepared by recording Opening Stock, Purchases, Manufacturing Expenses and other direct expenses on the debit side.

(iii) On the other hand sales and closing stock is recorded on the credit side of the trading account.

(iv) After that the balancing figure of trading account is determined by totalling both the sides, if the credit side exceeds the debit side, then the balancing figure is termed as gross profit, but if the debit side exceeds the credit side, then the balancing figure is termed as gross loss.

(v) Carry forward the Gross Profit (Gross Loss) to the credit (debit) side of the Profit and Loss Account.

(vi) After that all the operating and non-operating revenue expenditures with their relevant adjustments are recorded on the debit side of the profit and loss account. Record all current year’s operating and non operating revenue incomes with their relevant adjustments on the credit side of the profit and loss account.

(vii) Ascertain the balancing figure by totalling both the sides of the profit and loss* account. If the credit exceeds the debit side, then the balancing figure is termed as net profit, but if the debit side exceeds the credit side, then the balancing figure is termed as net loss.

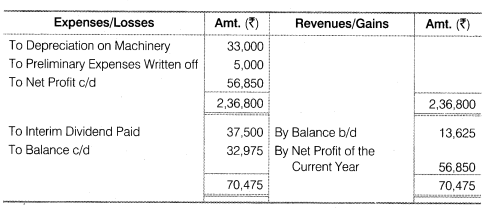

The process of preparing Balance Sheet is given below

(i) First of all match the total of both the side of trail balance. If there is any difference in the debit side of trail balance it will be posted in assets side of balance sheet and if there is any difference in credit side of balance sheet it will be posted in the liabilities side of the balance sheet.

(ii) Record all the debit balances of real and personal accounts on the left hand side (i.e., Assets side) of the balance sheet after making all adjustments for provision and other related items.

(iii) Record all the credit balances of real and personal accounts on the right hand side (i.e., Liabilities side) of the balance sheet after making all adjustments for interest and outstanding items.

(iv) Add Net Profit to the opening capital and deduct Net Loss, if any from the opening capital.

(v) Acertain the total of two sides, which must be equal.

NUMERICAL QUESTIONS

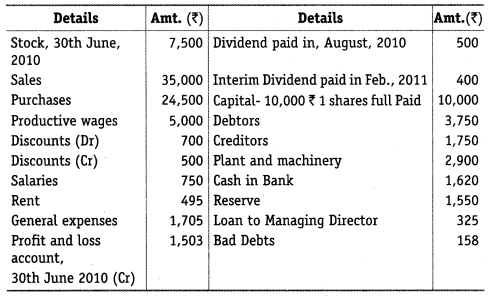

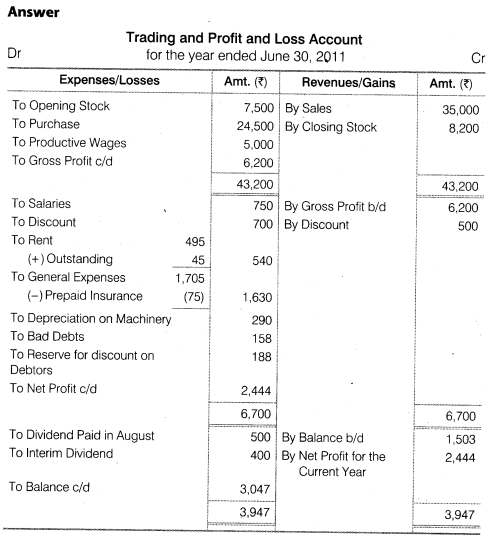

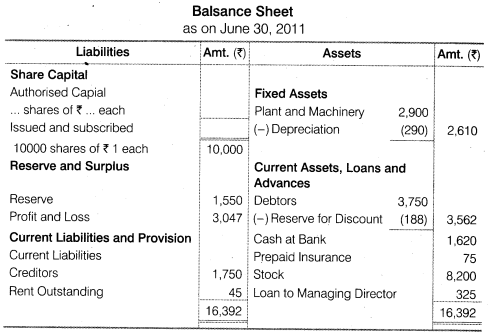

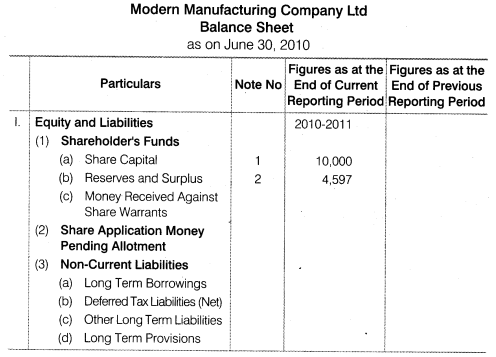

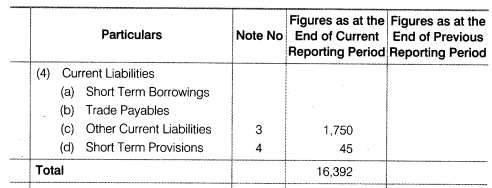

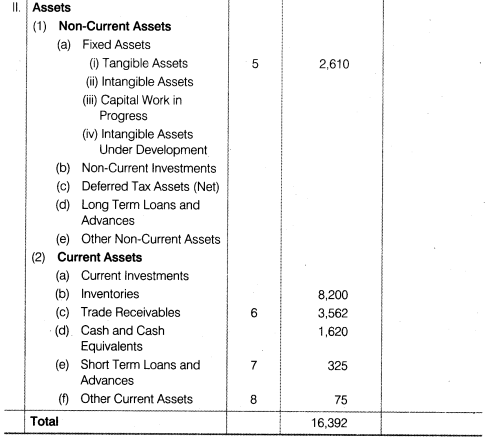

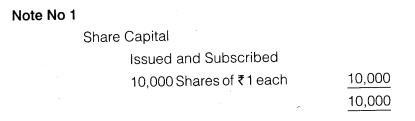

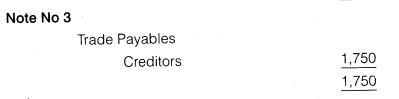

Question 1. The following is the trial balance on June 30, 2011 of the Modern Manufacturing Company Ltd.

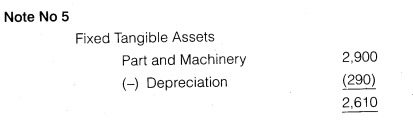

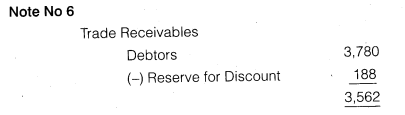

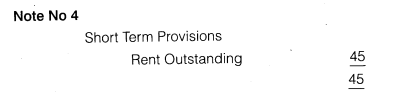

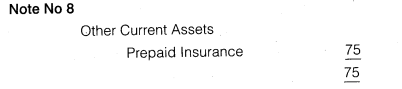

stock, on June 3, 2011 Rs. 8,200, you are required to make out the trading account, and profit and loss account for the year ended June 30, 2011 and the balance sheet as on the date, you are also to make provision in respect of the following: (i)Depreciate , machinery @10% per annum; (ii) Reserve 5% for discount on debtors; (iii) One month rent Rs. 45 was due on 30th june; and (iv)six moth’s insurance, included in general expenses, was unjexpired at Rs.75.

Note: Reserve for discount on debtors is rounded off to next rupee. The actual amount calculated was Rs. 187.50.

It has been assured that the dividend paid, August 2005 of Rs. 500 has been declared and paid is the same accounting period.

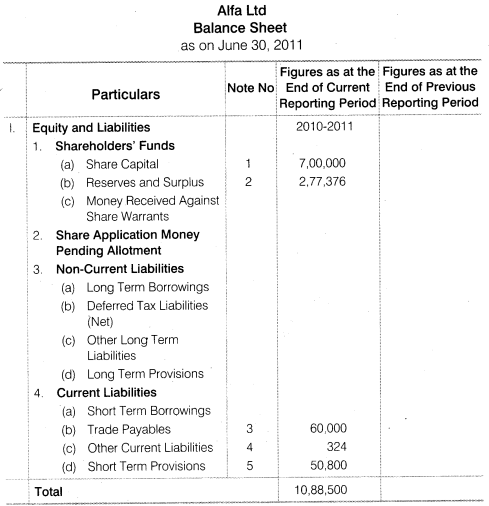

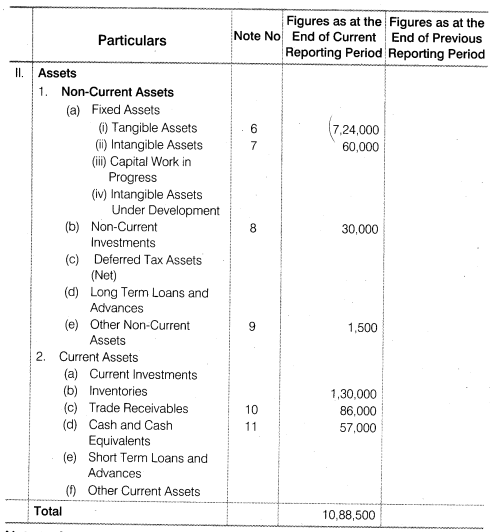

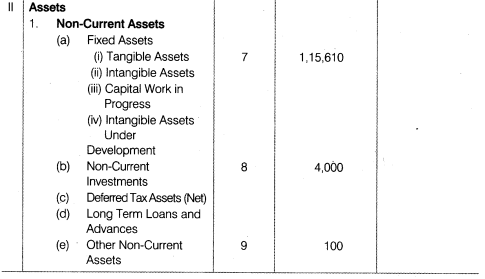

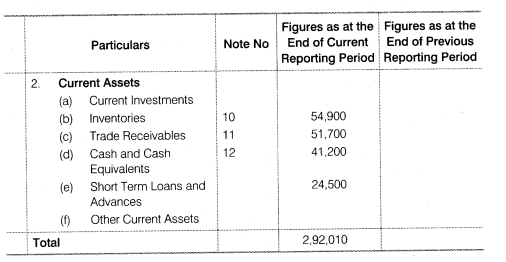

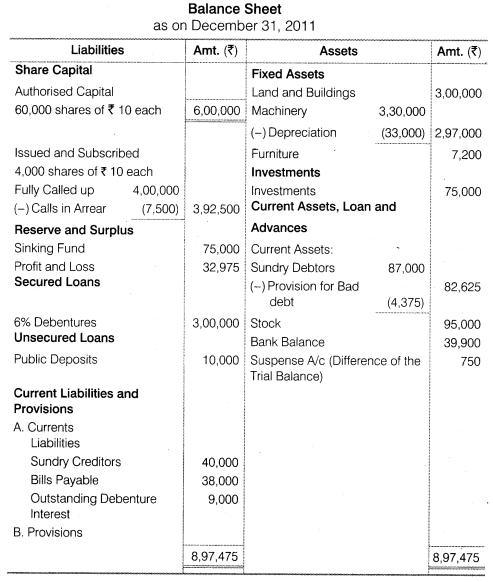

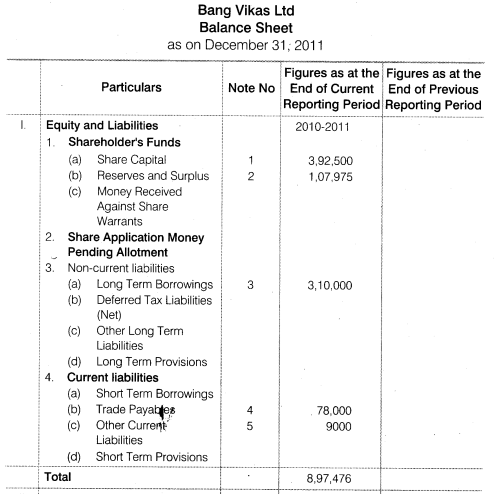

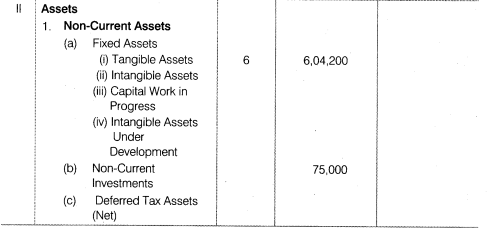

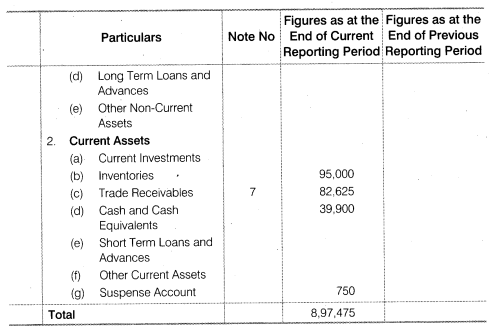

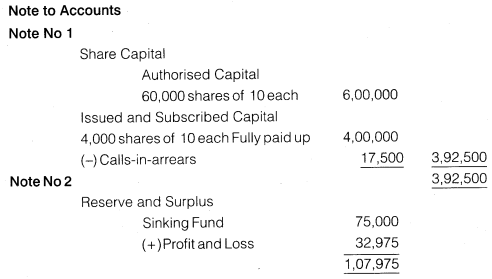

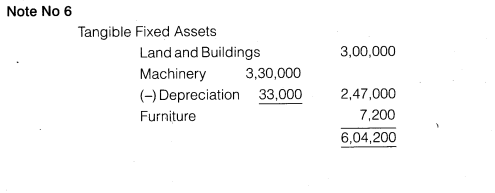

as per Revised Schedule VI applicable from 2013 Board examinations, balance sheet will be prepared as given below

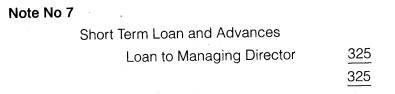

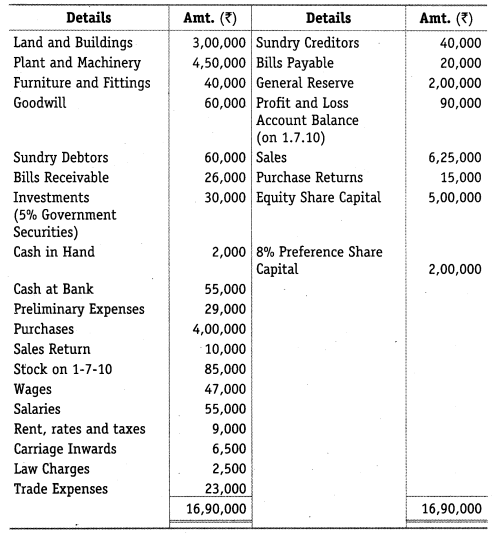

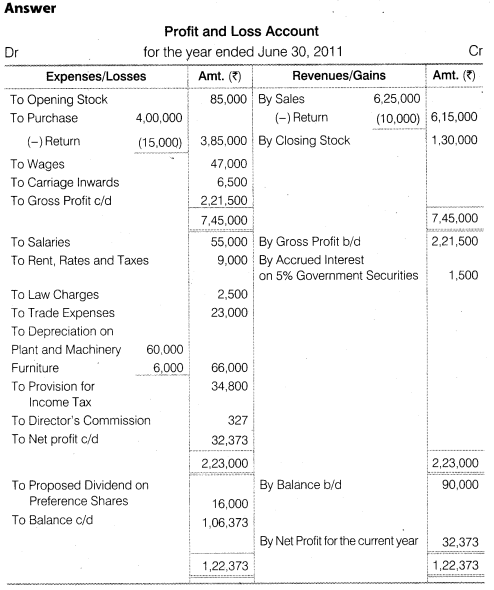

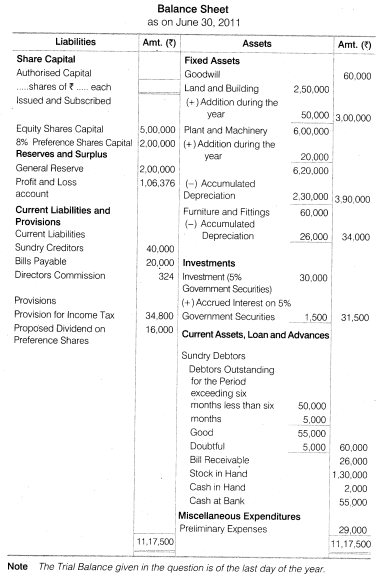

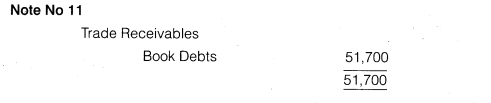

Question 2. The following is the trial balance of Alfa Ltd, for the year ended June 30, 2011

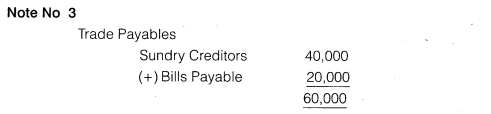

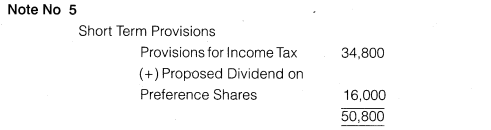

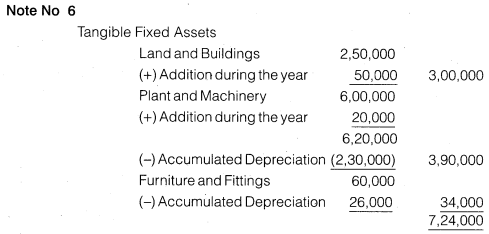

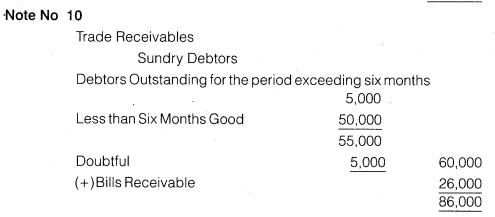

Prepare the profit and loss account and balance sheet of the company after taking the following particulars into consideration

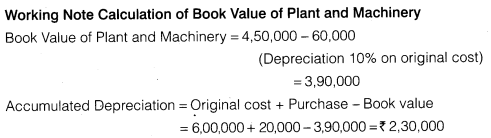

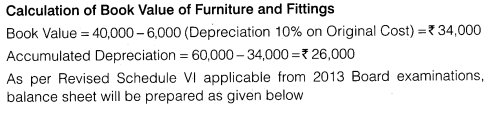

(a) The original cost of land and building plant and machinery and furniture and fittings was Rs. 2,50,000, Rs. 6,00,000 and Rs. 60,000 respectively- Additions during the year were building Rs. 50,000 and plant Rs. 20,000.

(b) Depreciation is to be charged on plant and machinery and furniture and fitting at 10 per cent on original cost

(c) Of the sundry debtors, Rs. 10,000 is outstanding for a period exceeding 6 months, Rs. 5,000 are considered doubtful, while the others are considered good.

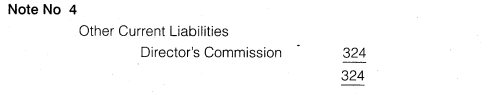

(d) The directors are entitled to a commission at 1 per cent of the net profits before charging such commission.

(e) Stock on 30th June, 2005 is Rs. 1,30,000.

(f) Provide Rs.34,800 for income tax.

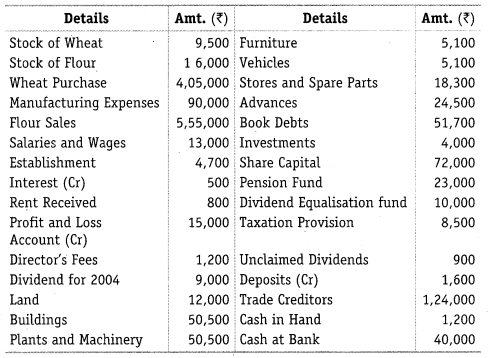

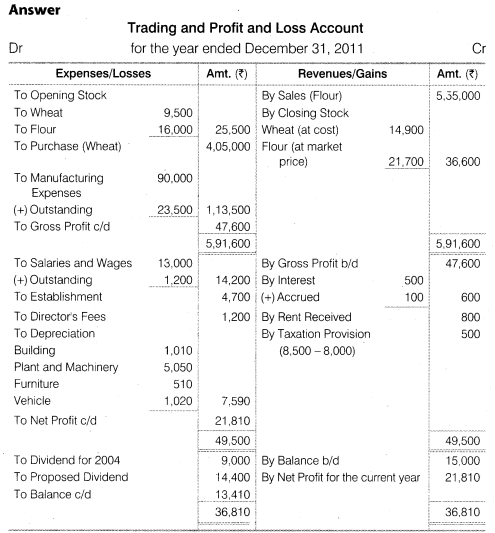

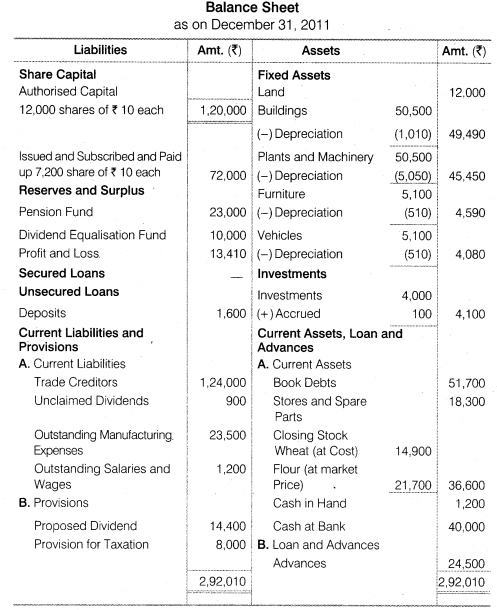

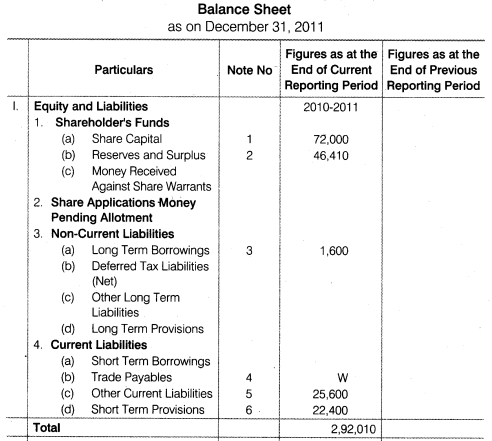

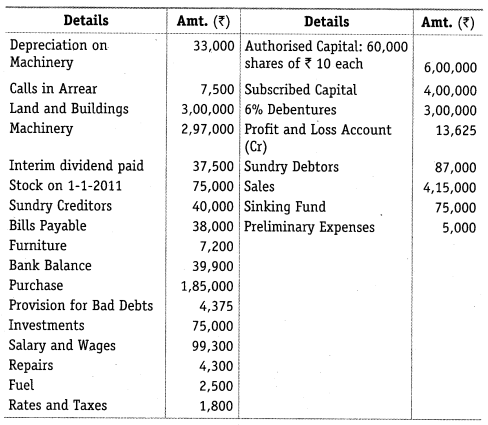

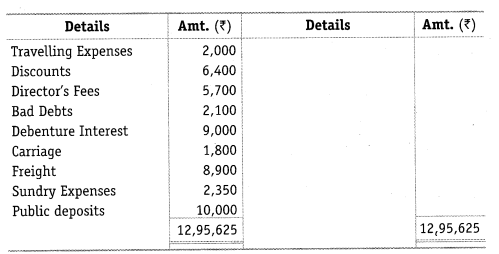

3. The following balances appeared in the books of Parasuram Flour Mills Ltd., as on December 31, 2005 :

Prepare the company’s trading and profit and loss account for the year and balance sheet as on December 31, 2005 after taking the following adjustments into account:

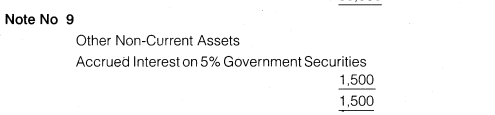

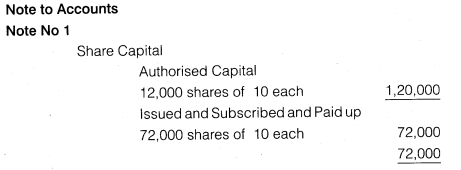

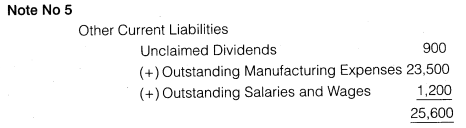

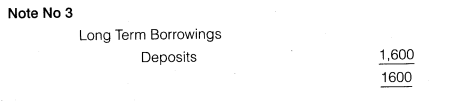

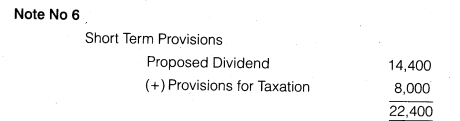

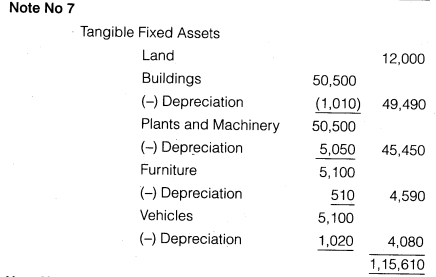

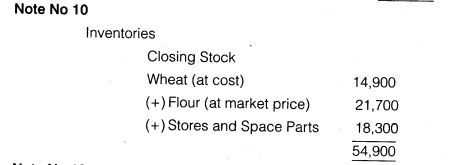

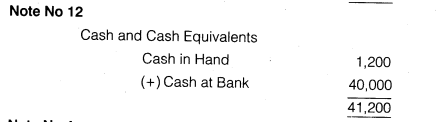

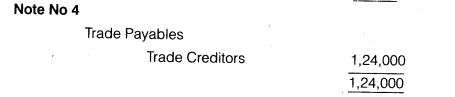

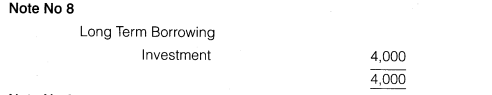

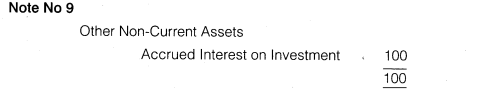

(a) Stock on December 31, 2005 were: Wheat at cost, Rs. 14,900: Flour at market price, Rs. 21,700; (b) Outstanding expenses: Manufacturing expenses, Rs. 23,500; and salaries and wages, Rs. 1,200; (c) Provide depreciation : Building at 2% ; Plant and machinery at 10%: Furniture at 10% ; and Vehicle 20%. (d) Interest accrued on Government Securities, Rs.100: (e) A tax provision of Rs. 8,000 is considered necessary. (f) The directors propose a dividend of 20%. (g) The authorised capital consists of 12,000 equity shares of Rs. 10 each of which 7,200 shares were issued and fully paid up.

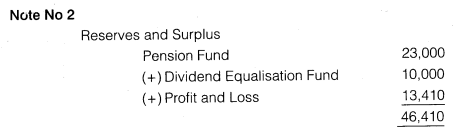

Note :Pension fund is assumed to be created out of profits. Dividend ? 9,000 is considered as declared and paid in same year.

As per Revised Schedule VI applicable from 2013 Board examinations, balance sheet will be prepared as given below.

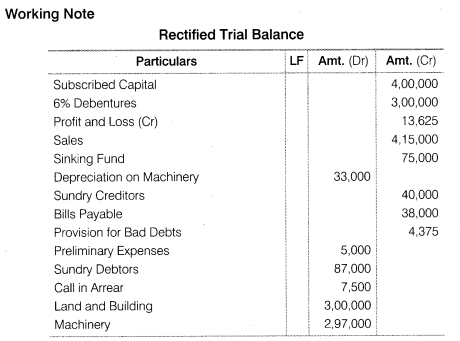

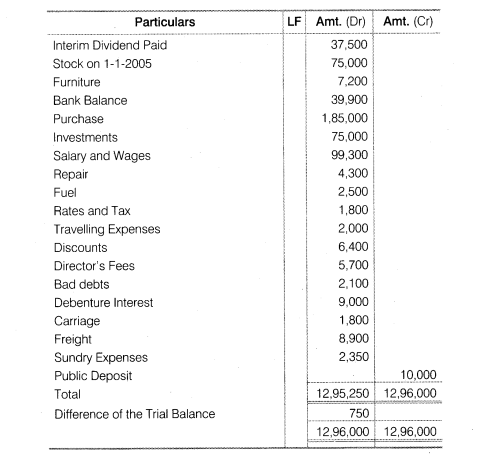

4. An unexperienced accountant prepared the following trial balance of Bang Vikas Ltd., for the year ending 31.12.2005. The cash in hand on 31.12.2005 was Rs. 750.

After locating the mistakes and making the following adjustments prepare

trading and profit and loss account and balance sheet in the prescribed form.

Adjustments: (i) Stock on 31.12.2005 Rs. 95,000 and (ii) Write-off preliminary

expenses.

Note: Rectified trial balance need not be prepared

As per Revised Schedule VI applicable from 2013 Board examinations, balance sheet will be prepared as given below

Working Note: Firstly the rectified trial balance will be made then the final accounts will be prepared.

Note: When the trial balance does not tally, it should be balanced by writing the difference amount on either side as required and then show it in balance sheet

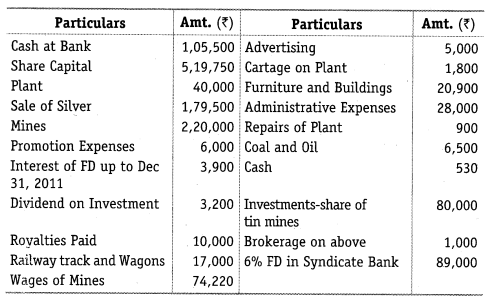

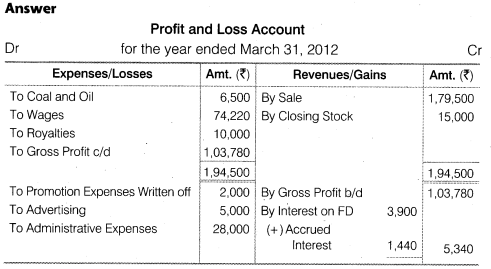

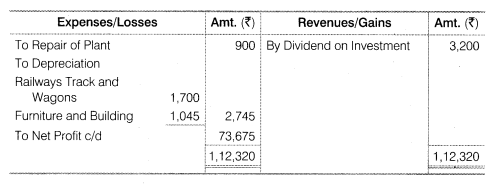

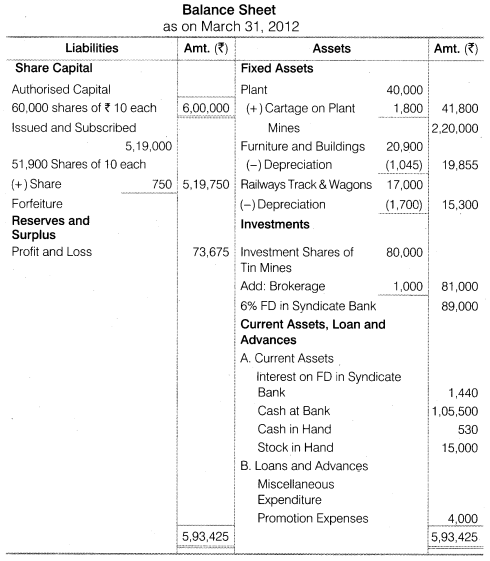

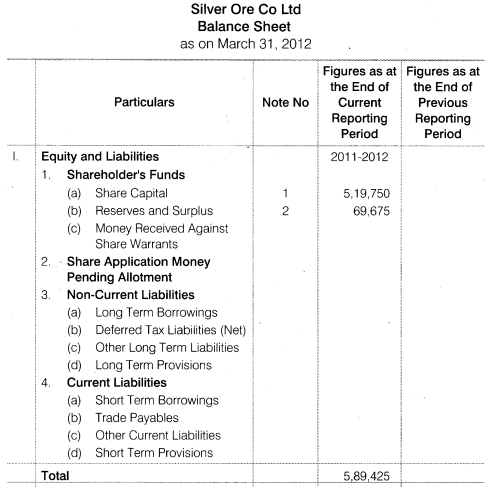

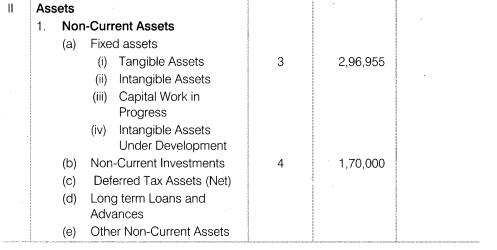

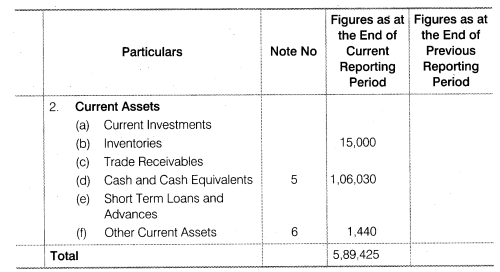

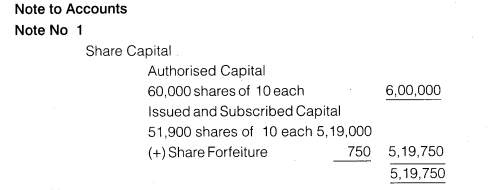

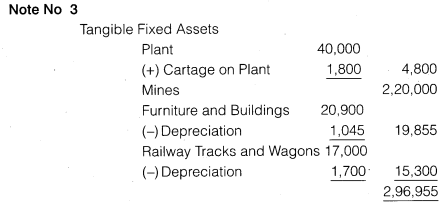

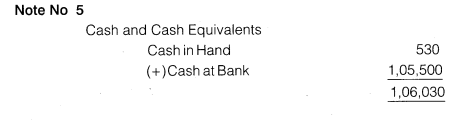

5. The Silver Ore Co. Ltd. was formed on April 1, 2005 with an authorised capital of Rs.6,00,000 in shares of Rs. 10 each. Of these 52,000 shares had been issued and subscribed but there were calls in arrear on 100 shares @ Rs. 2.50. From the following trial balance as on March 31, 2006 prepare the trading and profit and loss account and the balance sheet:

(i) Depreciate plant and railways by 10%; furniture and building by 5%;

(ii) Write off a third of the promotion expenses;

(iii) Value of silver ore on March 31, 1969 Rs.15,000. The directors forfeited on December 20, 1968, 100 shares on which only Rs. 7.50 had been paid

As Per Revised Schedule VI applicable from 2013 Board examinations, balance sheet will be prepared as given below

More Resources for CBSE Class 12

RD Sharma class 12 Solutions

NCERT Solutions for Class 12th English Flamingo

NCERT Solutions for Class 12th English Vistas

CBSE Class 12 Accountancy

NCERT Solutions for Class 12th Maths

CBSE Class 12 Biology

CBSE Class 12 Physics

CBSE Class 12 Chemistry

CBSE Sample Papers For Class 12

NCERT SolutionsAccountancyBusiness StudiesMacro EconomicsCommerce

<!–

–>